Everything you need to know about Pennsylvania child support laws, updated for 2020.

Pennsylvania child support laws require parents in the state to provide upkeep until the child is 18 or graduates high school.

On the face of it, these laws are beneficial to custodial parents, but in some scenarios, devastatingly burdensome to the paying parent. So, as a parent in the state, you must have a bevy of questions that need straight answers.

For example, are there ways to end child support early in Pennsylvania? Or what if the payor is unemployed?

Time to find out. But first, we must discuss the basics of child support in Pennsylvania.

How to apply for child support in Pennsylvania

The BCSE (Bureau of Child Support Enforcement) under the DHS (Department of Human Services), administers Pennsylvania’s child support program. What that means is to apply for services you must go to the BCE’s website, create an account, then “request support services”.

Alternatively, you may also visit the Human Services Office in your area.

Click here to locate the nearest office. *Side note, due to COVID-19, the BSCE encourages online applications.

What to remember:

- Online support request submission does not constitute a filing with your county court, and thus, your request becomes official only after the DRS (office of Domestic Relations) reviews and accepts it. The point is, it is best to apply in person or through an attorney to avoid having to repeat the process.

- The DHS, through the DRS, provides services including child support application, paternity establishment, domestic violence, and all related services.

- To apply for services, you need proof of the child’s paternity.

- Child support arrears begin on the date you file a petition/complaint.

- The information/documents you need to apply include, your name, social security number, place of employment, proof of expenses, income, special needs of the child, daycare costs, and as much information as you can get about your former partner.

- Filling a petition to proceed “In Forma Pauperis” (in the character or manner of a pauper) means that you do not have to pay filing fees. But this option is only available to low-income households.

- Parents who have never received cash assistance from the state must pay an annual $25 service fee.

Download child support application forms here.

Download acrobat reader to view the forms.

How is paternity established in Pennsylvania?

In matters of paternity, it is important to realize that Pennsylvania child support laws no longer recognize common law marriage. Instead, when a child is born to a married couple, the law automatically assumes that the man is the father. Whereas, a child born to an unmarried woman creates no legal relationship between the child and purported father unless the man signs a valid AOP/Acknowledgement of Paternity (PA/CS 611) or a paternity test proves the accusation.

What to remember:

- You may sign an AOP at the hospital after birth or at any time at County Assistant Offices, DRS, or DHS.

- Child Support Enforcement Paternity Coordinator’s number is 1-800-932-0211.

- An AOP is only legal if there are witnesses during the signing, and either party can cancel the AOP within 60 days after signing or before court proceedings.

Overall, the importance of paternity establishment in Pennsylvania is that it benefits the father in that he can now seek custody/visitation, the child gains benefits including inheritance rights and healthcare benefits, and the custodial parent’s upkeep burned decreases.

How to determine child support obligation in Pennsylvania

Pennsylvania child support guidelines are based on the Income Shares Model. The presumption behind the said model is “the child should receive the same proportion of income he or she would receive if the parents never split.

However, federal statute 42 U.S.C. 467 (a), requires the state’s legislature to review Pennsylvania child support laws every four years. (we will keep you updated whenever a new change occurs).

That said.

The state’s child support formula considers:

- The reasonable needs of the child and the parent’s ability to pay.

- The combined net incomes of both parents.

What to remember:

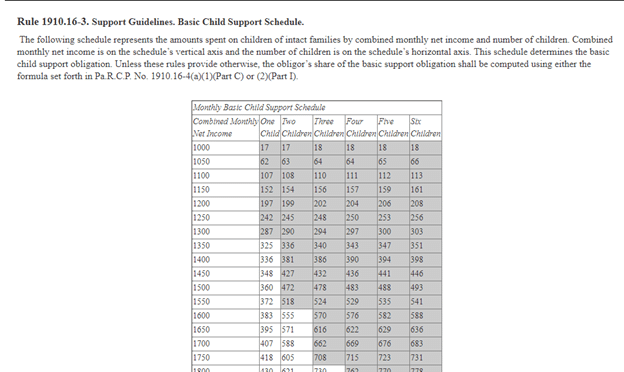

In 2020, Pennsylvania abandoned the chart of proportional expenditures/grids but retained the chart of the Basic Support Schedule. See the snippet below.

Pennsylvania child support schedule

Also:

- Under Pennsylvania child support laws, the judge can only deduct union dues, alimony paid, non-voluntary retirement payments, FICA, federal and local income taxes from the parent’s monthly net income.

- The main determinants of child support amount in Pennsylvania are the number of children covered by the support order, physical custody schedule, net income(s) of the parents, reasonable child-rearing costs such as daycare, and so on.

How to calculate child support in Pennsylvania

The DHS’s Child Support Estimator is based on Pennsylvania’s child support guidelines making it the easiest way for parents to get almost accurate results. I say “almost accurate” because the resulting amount is based on your input and there is no sure way of telling what the judge will include in his/her estimation.

Plus, the main priority for the judge or DHS is the best interest of the child, meaning if the resulting figure does not serve the child’s best interest, the law allows the judge to deviate from Pennsylvania child support laws.

How does it all come together:

- Use the linked Child Support estimator.

- To determine basic obligation, find the resulting figure on the chart of basic support schedule. you may also consult with a family court attorney for better accuracy.

How to modify child support in Pennsylvania

Pennsylvania child support laws require parents to petition or request an order modification at any time the caregiver experience a material change in financial circumstances.

For example, if you involuntarily lose your job, it means that you have less money coming in and thus incapable of paying child support. Conversely, if you decide to voluntarily quit your job, or if you are voluntarily underemployed, the courts will impute your income. Meaning, your obligation will be the same as when employed at full capacity.

This situation raises the question;

What are the grounds for support modification in Pennsylvania, and how do I apply?

As mentioned, the main determinant of order modification in Pennsylvania is a “substantial ongoing change” in your finances. Accordingly, some valid grounds for support order modification are:

- Changing childcare expenses.

- Job loss, reduced hours, promotion, a new job, or a new source of income.

- Medical coverage.

- Mental or physical disability (parent/child).

- Change of custody.

- Extraordinary expenses incurred to benefit the child.

How to apply for modification in Pennsylvania.

If your support order is unfair, the first step to win modification is to call or visit the DRS office handling your case. There, you will have access to a “petition for modification” form.

Another way to do it is to download the petition here, complete it, then return it to the DRS.

What to remember:

- The petitioning parent must present evidence that one of the factors listed above has changed.

- Incarcerated parents may access the Child Support Incarceration Packet.

- Either parent can request a modification.

- A written agreement between the parents may expedite the modification process.

To petition for modification or if you need more information, call 1-800-932-0211.

What happens if you do not pay child support in Pennsylvania?

Whenever a parent in Pennsylvania chooses not to pay support, the DRS or court first issues an automatic wage withholding order. Consequently, your employer or income source must withhold child support at the source. But what if you are self-employed or not formally employed?

In such a scenario or if efforts to hold your income fails, the DRS may use any of the following collection actions.

- State or national new hiring reporting: this option helps the DRS find delinquent parents inside or outside Pennsylvania.

- Federal or state tax offset: the DRS through other state agencies may intercept the delinquent parent’s tax returns whether state, local, or federal.

- Financial institution data match: through this option, the DRS can find your bank account(s) and garnish child support.

- Credit bureau reporting: the DRS may forward your information to all major credit bureaus impacting your financial interests countrywide.

- Passport denial: through the department of state, the DRS can deny or revoke your passport if you owe more than $2500. This rule also applies to lottery winnings.

- Lumpsum interception: all reasonable payments including, worker’s compensation, personal injury payments, and so on, are all subject to garnishment by the DRS.

Note that the DRS may publish the delinquent parent’s information in local newspapers if you owe more than one month’s worth of back support. Also, you might face criminal non-support charges.

Criminal Nonsupport in Pennsylvania

Title 23-4354. Willful Failure to Pay Support Order, defines non-support as;

“an individual who willfully fails to comply with a support order of a court of this commonwealth when the individual has the financial ability to comply with the order commits an offense.”

Nonsupport is a misdemeanor in Pennsylvania and the punishment ranges from one-year imprisonment for a third-degree offense, two years for a second-degree misdemeanor, and five years for a first-degree misdemeanor.

What to remember:

- Nonsupport civil contempt charges carry a sentence of 6 months in prison or a $500 fine.

- You can prevent collection action by modifying your order or paying owed support.

- The court may order enrollment to a parenting program, community service, or work release program for incarcerated parents.

When does child support end in Pennsylvania?

Although the courts terminate child support automatically on the child’s 18th birthday, it is in either parent’s best interest to contact the DRS or court at least six months before the due date.

For the receiving parent, this may be your last opportunity to petition the court for an extension if say the needs of the child change. On the other hand, notifying the DRS and or the receiving parent is beneficial in that you will not have to pay more than you owe.

What about college or higher education tuition?

Pennsylvania child support guidelines do not allow judges to order upkeep past 19. however, a legal agreement between the parents may extend support until the agreed-upon period elapses.

So, if you are worried about college or university fees, talk to your partner and establish a suitable payment plan.

Emancipation in Pennsylvania

In Pennsylvania, there is no formal court process/statute for minor emancipation i.e. you cannot legally move out at 16 without parental consent.

More Pennsylvania Laws