Everything you need to know about Ohio child support laws, updated for 2020.

According to the state’s Office of Child Support services, if you are a parent and your former partner refuses to pay. You should contact the CSEA for assistance. But what about the paying parent? What protections, rights, or tools can you use to ensure that your child support order is fair?

We explore the answers below.

Also included are child support application steps, the state’s upkeep worksheet, a step by step guide for modification of support orders, and how to end your support obligation early.

How to apply for child support in Ohio

In Ohio, the Department of Job and Family Services has the authority to help parents establish support orders, locate parents, establish paternity, enforce child support orders, terminate support, and all other related upkeep services.

Therefore, to apply for services, call 1-800-686-1556, or download the official Ohio child support app below:

Ohio child support app for apple/IOS devices.

Ohio child support app for android/google devices.

Alternatively, you can schedule an appointment with your local child support office.

What to remember:

- Ohio Child Support payments start on the date a parent files a court order; thus, the system does not allow retroactive collection.

- The law allows you to represent yourself or to hire a family court attorney.

- To apply. You will need your ID, proof of residency, the child(ren)’s birth certificate, last known whereabouts of your former partner, paternity test results, divorce records, income information, support history, social security cards, property descriptions, or any other related document.

Establishing Paternity in Ohio

Under Ohio child support guidelines, parents can establish paternity in three ways. One is via the signing of an Acknowledgement of Paternity Affidavit. Two, through Court Order. And, three, is via Administrative Order of Paternity.

Administrative order of paternity is a situation where a government agency conducts genetic testing and then issues an order of paternity.

What to remember:

- The CSEA (Child Support Enforcement Agency) may pay for testing then request reimbursement from the father at a later date.

- Mothers in Ohio can legally deny access to the child or move to another state if the child’s paternity is unknown.

- The importance of establishing paternity in Ohio is that it allows fathers to get more visitation time, custody, and it grants you the right to claim the child as a dependent on your tax returns.

- Fathers in the state can file a paternity lawsuit when denied visitation or denied a paternity test.

- After paternity establishment, the kids will have access to benefits including medical insurance, inheritance rights, veteran’s benefits, and social security.

How is child support determined in Ohio?

Parents in Ohio can establish support in court or via an agreement. one reason to make an out of court agreement is the paying parent will have greater control because the outcome depends on the negotiations.

However, the final agreement must capture the best interests of the child. What that means is, the formula Ohio uses to disburse parental obligation is based on:

- The income(s) of both parents.

- Medical insurance.

- Child care expenses including daycare.

- Parenting time.

- Any other consideration as per Ohio child support guidelines.

How to calculate child support in Ohio

To calculate or estimate child support obligation in Ohio, parents can use the state calculator here.

To use the calculator above, you will need your gross income and the information listed above. Also, if your combined incomes surpass $336,000. The CSEA advises you to contact your local child support offices or an attorney.

Ohio child support worksheet

The state of Ohio also provides a worksheet for sole/shared parenting child support. The three-page worksheet requires a guideline manual (JFS 07766) to complete.

In general, what the courts will do when dividing parental financial obligation is:

- Determine the parents combined monthly gross income(s).

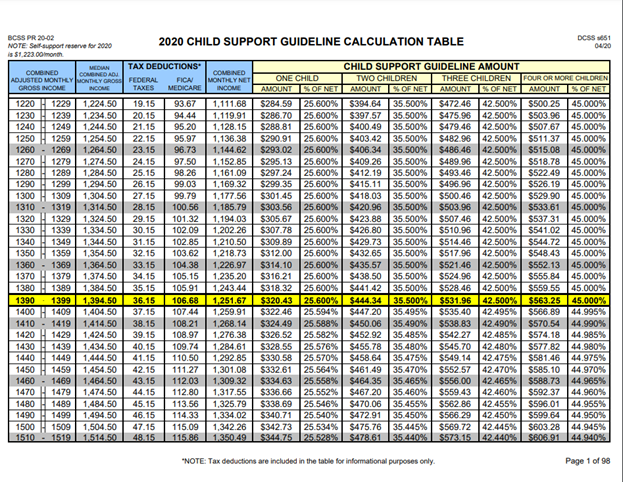

- Estimate basic support using the State’s 98-page child support guideline calculation table.

- Determine each parent’s percentage of the combined gross income.

- Then award individual basic support obligation.

Below is a snippet of Ohio’s Child Support Guideline Calculation Table, that you can download here.

Ohio child support guideline calculation table.

It is worth noting that the higher-earning parent often pays more and your estimations depend on your input. Thus, provide accurate information for better estimation.

Ohio child support law changes 2019

In 2019, the legislature made the following changes to Ohio child support guidelines:

- Ohio legislature introduced protections for parents earning less than $14000 per year or less. Hence, upkeep obligation, cannot surpass your income.

- Parents can now reduce their obligation by getting more parenting more. For example, if parenting time is greater than 147 overnights annually, the court must reduce your obligation or explain to the parent why reduction cannot happen.

- The paying parent can deduct child support from his/her yearly income, whereas, the receiving parent is directly responsible for the child’s health insurance.

- The Department of Jobs and family services must now review upkeep cases every 36 months.

How to modify child support in Ohio

If your child support order is unfair or if the needs of the child change, either parent can contact the CSEA and request for modification. Due to recent changes, the law requires the CSEA to review and recommend changes to support orders every three years. A review here means that your caseworker will look at both parents’ income information to see whether the parent’s support order needs changes.

Also, it is possible to qualify for a review or adjustment if you involuntarily lose your job and stay unemployed for 30 consecutive days or experience a 30% decrease in your income.

If your income increases, your partner can petition the court or CSEA to increase obligation, thus, the amount may go up or down.

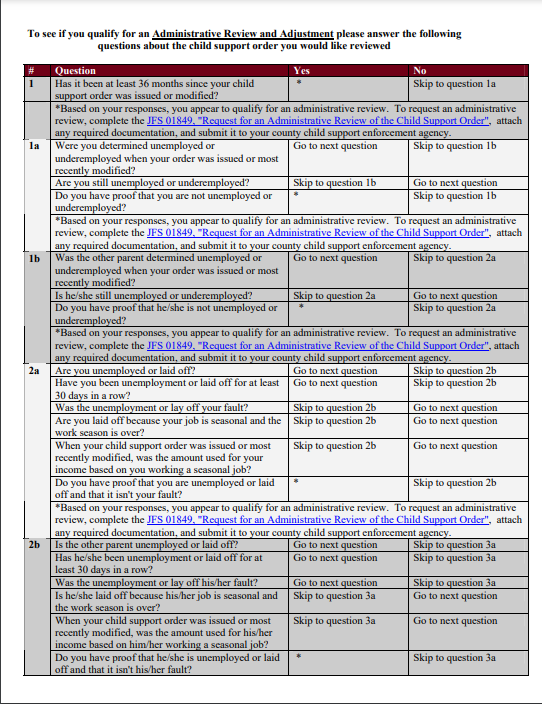

Normally, this is where I tell you to contact a family court attorney to see if you qualify for a support modification. But Ohio child support guidelines go the extra mile in helping you. By that I mean, the state provides an Administrative Review and Adjustment questionnaire to help you figure out if you qualify for support. See the snippet below.

Page 1 Ohio modification administrative child support review and adjustment questionnaire

Download the administrative review adjustment questionnaire here.

If you are sure that you qualify for a support modification, contact the CSEA and request for an Administrative Review or call 1-800-686-1556.

What to remember:

- Each county has a CSEA office.

- Parents representing themselves in court should read The Ohio Administrative Code Rules at: http://codes.ohio.gov/oac/5101%3A12-60-05.

Grounds for child support modification in Ohio

A substantial change in circumstances may include:

- Mental or physical disability.

- Institutionalization or incarceration with no assets or income.

- Increase or decrease in the cost of health insurance.

- Active military duty.

- Involuntary job loss.

- And any situation that involuntarily impacts the paying parent’s income.

What to remember:

- The court imputes income if the parent is voluntarily underemployed or unemployed.

- The courts or CSEA can deviate from Ohio child support guidelines if the resulting amount is unjust or inappropriate.

- Other grounds for deviation from Ohio child support guidelines are special and unusual needs of the child(ren), extraordinary obligations for other kids from the relationship, the physical and emotional needs of the child, and other relevant factors.

- To modify a support order through the courts, the petitioning parent must show a substantial continuing change in circumstances.

- Remarriage may impact your support order because the law assumes your household income needs have changed.

- To request a review, you must complete the JFS 01849 “Request for an Administrative Order Review.”

What happens if you do not pay child support in Ohio

Under Ohio revised code 3121.01. When a parent in Ohio fails to honor his parental financial obligation, the receiving parent can petition the court to find him in contempt. Usually, the judge grants the accused opportunity to explain his/her failure. Depending on the outcome of such hearings, the judge may order jail time depending on the amount in question or substitute jail time with community service.

The CSEA and courts may also use the following collection actions to force parents to pay:

- Issue bench warrants for the arrest of the non-custodial parent.

- Income withholding: through income withholding orders, the court or CSEA may collect child support from the paying parent’s wages, unemployment, veterans’ disability, and other relevant benefits.

- License suspension: the CSEA through other state agencies may revoke or suspend the payor’s sporting, recreational or occupational license.

The CSEA or court may also enforce support orders via:

- Passport denial.

- Credit bureau reporting.

- Garnishment of state, local, and federal tax returns.

- Placement of liens on personal and reals state property.

- Benefits withholding.

Criminal nonsupport in Ohio

The state of Ohio punishes criminal non-support on two levels, one as a misdemeanor. And two as a felony. Consequently, if a parent fails to provide support and he/she has the resources to pay. For a first offense, the parent will face misdemeanor nonsupport charges.

Misdemeanor charges in Ohio carry a $1000 fine, six months in jail, or both.

If the parent failed to provide support for 26 consecutive weeks or if the parent has previously pled guilty/convicted. That parent may face felony fourth-degree or felony fifth-degree charges. Both charges carry a maximum sentence of $2500 fine or five years in prison.

When does child support end in Ohio?

According to Ohio child support laws, parents must provide upkeep until the child turns 18. But there are exceptions such as a child who has not graduated high school by the age of 18.

In such a situation, your obligation will continue until the child’s 19th birthday. Also, if your child support order requires you to provide college or university tuition, or if you made a legal agreement to cater for higher education expenses. Your order will end once you honor the conditions of the order.

But remember, you can always push for modification if your financial circumstances change in court or through mediation.

What to remember:

- The payor must notify the CSEA of imminent child support termination (not automatic).

- You must pay owed back support after the termination of a child support order.

- Parents who overpay might receive a refund from the payee’s state tax offset.

How to terminate child support early in Ohio

Emancipation is an option for kids in troubled homes that grants them the rights of an adult but without privileges such as alcohol or tobacco use. Once the court awards you emancipation, it means that you can sign a lease contract or move out at 16.

In Ohio, the law does not allow minors to sign a petition, but the court may appoint an attorney to represent you or let you file an emancipation petition in your name.

So, consult with a family court attorney to see if you qualify for emancipation.

More Ohio Laws