On July 1st, 2017, new changes made to Illinois child support guidelines took effect. Consequently, today, child support is based on the adjusted net income of both parents.

But the changes do not end there and some affect your current child support order. So, if you are a parent in the state, whether custodial or non-custodial, here is how the new Illinois child support guidelines affect you and your relationship with your child.

Before this, support relied on the net income of the payor.

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a lawyer here.

- How is child support calculated in 2020 Illinois?

- How do I contact the Division of Child Support Services in Illinois?

- Do you have to pay child support if you have joint custody in Illinois?

- New Illinois child support guidelines: Can you petition to modify child support in Illinois?

- What happens if you do not pay child support in Illinois?

- How do I stop child support in Illinois?

How is child support calculated in 2020 Illinois?

As hinted at above, Illinois now uses the income shares method in distributing parental financial obligation. Accordingly, to determine an approximate amount, what the court does is:

- Combine the incomes of the parents.

- To identify the amount the couple might have spent on the child if they chose to be together. The court employs a statistically valid table of expenditures.

- The amount from the table is your basic child support obligation.

- The court determines and assigns obligation considering “other factors.”

This is the simplified version, keep reading for deeper insight.

To clarify, the expression “other factors” refers to extraordinary circumstances that may affect child support. For example, taxes, medical insurance, and so on.

What are the new child support laws in Illinois?

According to 750 ILCS 5/505. the “Percentages Method” is no longer valid, instead, the version of the income shares method the state adopted prioritizes the incomes of both parents excluding :

- Benefits received from public assistance programs such as nutritional assistance and temporary assistance for needy families.

- Income and benefits received by a parent for other children.

. A section of the law reads, quote:

“to calculate child support based upon the parents combined adjusted income estimated to have been allocated to the child if the parents and child(ren) were living in an intact household.” The Illinois department of health Care and Family Services is to adopt rules establishing child support guidelines which include worksheets to aid in the calculation of child support obligations and a schedule of basic child support obligations…”

What does this mean?

First, the easiest way to determine your parental obligation is to use the state’s official calculator. Here is an alternative version for attorneys in the state.

Second, parenting time affects your obligation.

Third, under public act 100-0923, standardized net income tables are employed in the determination of child support. Find all the tables here.

That means, when calculating child support, state law requires the court to. One, determine parent’s monthly net income. Two, add the parents’ net income. Three, select an appropriate amount from the tables in the link above. Four, calculate each parent share.

However, if the court finds that the amount is unfair to one parent given his/her circumstances, or after considering the best interest of the child. Child support is determined considering the following factors:

- The financial resources and needs of the parents.

- The standard of living the child would enjoy if the civil union or marriage stood.

- Educational and emotional needs of the child.

How do I contact the Division of Child Support Services in Illinois?

You can either visit the DCSS website, consult with a clerk of courts, or call this service number 1-800-447-4278.

Do you have to pay child support if you have joint custody in Illinois?

Parental shared time does not affect child support in most states that use the income share method. Hence, the higher-earning parent often pays more for the sake of perceived fairness.

This raises the question:

New Illinois child support guidelines: Can you petition to modify child support in Illinois?

In Illinois, child support modification is as simple as calling this toll-free number 1-800-447-4278. But remember. DCSS modifications only apply in matters of health care. Whereas judicial orders are modified via the courts, and administrative orders through Health care and Family Services.

What are the conditions for child support modification in Illinois?

Before you petition the court or DCSS, the following conditions must exist.

- A substantial change in the non-custodial parents’ income (unemployment, disability, incarceration).

- Three years must subside after the establishment of the order, modification, or review.

- The DCSS receives a written request for review from either parent within or outside the state.

It is worth noting that whenever there is a substantial increase in one parent’s income, the other can request a modification. Furthermore, these changes may be retroactive, thus, if one parent gets a raise and does not tell the other. The receiving parent can request for back support.

Additionally, the court may deny your request for modification if it finds that you are voluntarily unemployed or underemployed. Accordingly, your circumstances must be “right” to get a modification.

What happens if you do not pay child support in Illinois?

To enforce child support in Illinois, the custodial parent must request a support order. Click here to apply for services or to check how much you owe.

That said. Failing to pay child support in Illinois is a punishable offense. Therefore, the consequences listed below are remedies or avenues to force parents to pay. Yes, jail time is a possibility, but that is often the court’s last resort because it hinders the delinquent parent’s ability to pay.

That is not to say that these remedies are lenient though! The fact of the matter is, some of them can make life, work, and financial progression a nightmare.

What is important to remember is federal law can be employed in certain circumstances.

Child support enforcement actions in Illinois:

- Garnishing a bank account.

- Suspension of drivers, recreational or specialist license (s).

- Placing a lien against the delinquent parent’s property.

- Intercepting state and federal income refunds.

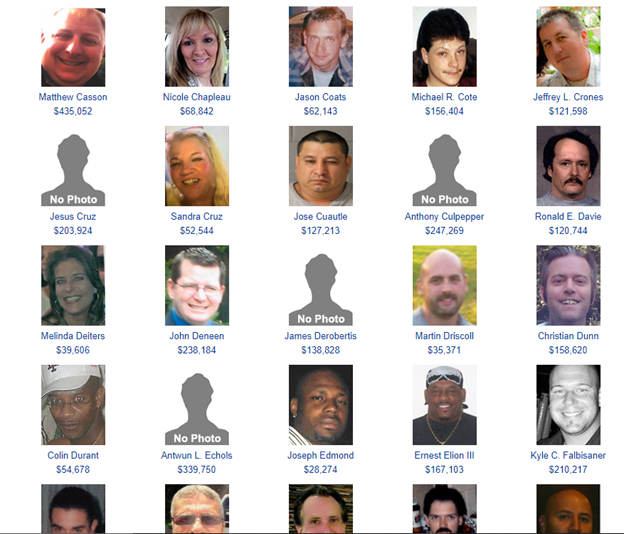

Additionally, if the amount of back support surpasses $2500, the state may deny or revoke your passport. Likewise, if the amount exceeds $5000, Illinois Public Aid code 305 ILCS 5/12-12.1 allows the use of shaming tactics under the “deadbeat” program. What that means is, you will join the unisex list of wanted child support offenders.

Can matters escalate?

For clarity, I will put this information in order.

- In Illinois, child support arrearage greater than $5000 is a class A misdemeanor. That crime is punishable by up to one year in jail.

- Evading child support by leaving the state is a class 4 felony.

- And so is failing to pay for more than one year or an arrearage of $20,000.

A class A felony is punishable by NOT LESS than one year in prison. Uniquely, the maximum sentence is three years but that can change depending on circumstances. Also, although jail is often the last resort, the court may employ a work-release basis to ensure that the parent does not miss payments.

Do Illinois child support laws allow parental debt forgiveness?

The HFS offers indebted parents a way out. Therefore, the benefit of pursuing this program is that it permanently removes past due payments or debts owed to the state. But as expected, the following four conditions/proof must exist to prove your case:

- A statement of earnings from social security administration.

- Doctor’s statement or proof of disability.

- Parole papers or prison discharge.

- A written notice from your former employer stating the day of a layoff, factory closing, and such.

Call this number 1-800-447-4278.

How do I stop child support in Illinois?

Normally, child support in Illinois terminates once the child reaches 18. However, parents can end their obligation earlier if:

The child chooses emancipation

Emancipation allows the payor to legally terminate payments because the child is an adult in the eyes of the law despite his/her age. To qualify for emancipation, the child must be 16 or more, he or she must demonstrate to the court financial independence, and that you can live independently.

Remember it is up to the judge to decide, so emancipation can happen even if your parents’ object. The only caveat is, you must prove that emancipation is in your best interest. Another option is the termination of parental responsibility.

How to terminate child support: Can a father sign over his rights in Illinois?

Yes, a judge can terminate parental obligation in Illinois. However, the state, not the parent, must prove that the parent (s) is unfit for this type of responsibility. What do I mean?

If one parent gets remarried and his/her new spouse has agreed to adopt the child. Proving that your former partner abandoned, failed to maintain reasonable interest or concern for the child, physically or emotionally abused the child, committed certain depraved crimes such as sexual assault, abuses drugs, and so on. Might prompt the court to revoke your former partner’s parental rights.

But remember, the burden of proof is on you who is seeking to demonstrate that the other is unfit.

Get married or join the military

Minors in Illinois can legally marry with parental permission.

When a minor, over 16 gets married. Legally, the parents no longer have any obligation over him or her. The other alternative is to join the army, marine core, or armed forces.

Remember, once you join the army, the army “owns” you in a similar manner your parents did. On top of that, if you are below 18, you need parental consent to join the army.

You could also opt for adoption, but that is an entirely different topic.

Overall, what is important is to consult with a family court attorney throughout the process to guarantee your rights. Also, navigating Illinois child support guidelines on your own can get tricky, so ask any question in the comment section.

If you require the assistance of an attorney familiar with Illinois Family Law you can get a free consultation with a lawyer here.

More Illinois Laws