Everything you need to know about Child Support Laws in Hawaii. Updated 2020.

Hawaii child support guidelines place parental care as the responsibility of both parents, consequently, both parents whether married or unmarried must cater to their child’s needs.

According to modifications made in 2014, these guidelines must be followed UNLESS there is an exceptional circumstance. What are ‘exceptional circumstances’? What does it mean for your relationship with your child(ren) and what happens if you don’t pay child support in Hawaii?

If these questions keep you up at night, this article will help clarify any grey areas in the laws that might affect you directly. So, here is what you need to know about child support in Hawaii.

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a lawyer here.

- How do I apply for child support in Hawaii?

- How is the amount of child support determined in Hawaii?

- How to modify child support in Hawaii

- What happens if you don't pay child support in Hawaii?

- Is there a statute of limitations on back child support in Hawaii?

- How long do you have to pay child support in Hawaii?

How do I apply for child support in Hawaii?

Generally, in matters of child support, the Courts, CSEA, or OCSH have the authority to order parents to pay support. Therefore, for custodial parents, contacting these agencies is your first step to securing support.

Or you can consult with a family court attorney in your area.

is Hawaii a mother state?

No, Hawaii is not a mother state, instead, the courts use the “best interests of the child” standard as the main driving factor. Meaning, custody is not based on preference, thus both parents have an equal right to custody and time with the child.

Additionally, Hawaii child support guidelines are based on four principles, that is:

- Each child’s basic needs are met before parents retain any additional income.

- Health insurance and the cost of child care are basic requirements.

- Kids are entitled to a share of any additional income that remains after his or her needs are met.

- To facilitate continued employment or basic needs, each parent is entitled to keep sufficient income.

It is worth noting that parental abduction is a real problem in Hawaii. Consequently, the courts allow special provisions in custody orders that can help prevent parental or family abductions including:

- A clause that restricts the removal of the child from the state.

- Joint custody.

- A provision that prohibits the removal of the child from the country without a written agreement approved by the court.

How is the amount of child support determined in Hawaii?

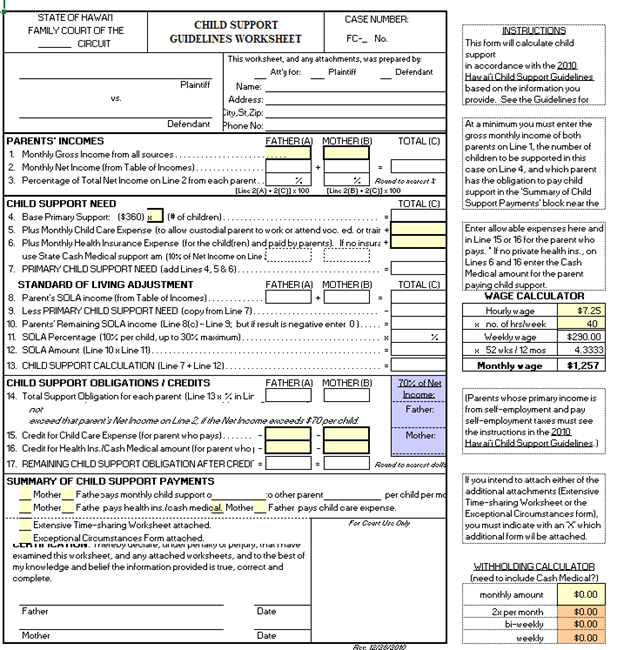

Hawaii courts employ CSGW or “the guidelines”, a formula that is based on the Income Shares Model.

The CSGW formula takes into account:

- General considerations including support, maintenance, and education (including adult kids).

- Education and vocational training considerations.

- Mental or physical disability.

- Retirement benefits.

- Social security benefits.

- Medical support.

- Cash medical payments.

In general, below are the main considerations.

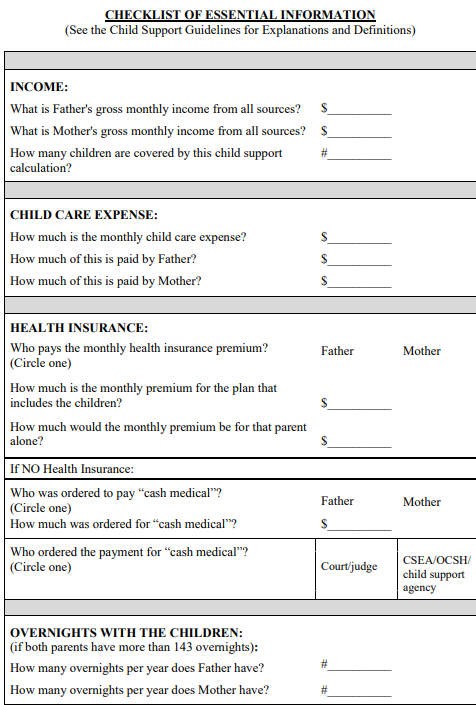

Although the formula is complicated, Hawaii courts provide worksheets that you can use to estimate your obligation. See the image below.

That said, in Hawaii, minimum child support is $70 per child, and health insurance is 10% of the combined net income of the parents. Additionally, it is vital to remember that state law only allows agreements that stipulate a higher amount. Meaning, child support can only be lowered if exceptional circumstances exist.

What are ‘exceptional circumstances’ for Child Support in Hawaii?

Exceptions are situations where the court or enforcement agency deviates from Hawaii’s child support formula. These deviations include but are not limited to:

- Child support exceeds 70% of the obligor’s net income.

- Support for additional children.

- Extraordinary needs of the children or other parents such as a disability or special education.

- Inability to earn income (incarceration, disability, involuntary unemployment)

- Private education expenses.

Does remarriage affect child support amount in Hawaii?

NO, state law does not consider remarriage and the following circumstances as exceptional.

- Agreements that were made out of court for a lesser amount.

- Visitation expenses.

- Heavy debt.

How to modify child support in Hawaii

Parents who feel that the amount of child support they pay or receive is unfair are allowed to modify payments if.

One, there is a substantial change in income, two, if the needs or expenses of raising the child change, and, three, when there is a change in the number of kids receiving support.

Consequently, if you lose your job, or if your former partner secures a better-paying one. Contact the courts or any of the two aforementioned enforcement agencies. But remember, you must arm yourself with:

- Proof that the change will benefit the child.

- Demonstrate to the court the needs of the child or parents have changed.

That means the burden of proof is on the parent seeking a modification, so consult with a family court attorney to find out if your situation applies.

What happens if you don’t pay child support in Hawaii?

In Hawaii, federal and state laws provide a bevy of remedies aimed at forcing delinquent parents to meet their parental obligation. Furthermore, Enforcement is automatic, meaning, the state relies on KEIKI which is an automated child support system.

Dumbed down what that means is, the CSEA, courts or OSCH are allowed to:

- Withhold the delinquent parent’s income

Income withholding taps the non-custodial parent’s income at the source; thus, your employer will garnish your paycheck before you receive it. For employers, here is everything you need to know.

- State and federal tax setoff

Statute 231-51 to 231-5 allows the collecting agency to intercept state tax refunds if the amount is at least $25. On the other hand, federal taxes are intercepted via the collective action of IRS (internal revenue services), FMS (Financial management Service), Child Support Enforcement Agency, and the Federal Office of Child Support Enforcement (OCSE).

- Passport denial

If you owe more than $2,500 in back child support, state law allows the Secretary of State to revoke, restrict or limit your passport. ‘

- Credit bureau reporting

Section 576D-6 of Hawaii’s revised statutes and title 5-31-29 of Hawaii administrative rules. Grant child support enforcement agencies in the state the authority to give the delinquent parent’s financial information to credit bureaus. This action may affect your credit score, mortgage, and the likelihood of getting a loan in the future.

- Liens

Liens can be created when the non-custodial parent becomes delinquent. Typically, liens are attached to all interests in any real property you own or subsequently acquired, which includes your home, car, property, etc.

- License suspension

Enforcement agencies can push for the suspension of the delinquent parent’s professional, vocational, business, and recreational license. If any of your license(s) is suspended or revoked, it will only be reinstated once you no longer owe any support arrears.

Is there a statute of limitations on back child support in Hawaii?

According to state law, the statute of limitations for child support enforcement is 10 years after judgment or the 33rd birthday of the child.

Furthermore, interests on, judgments are not allowed nor do interest on retroactive support and missed payments. However, state law requires that paternity must be established within three years of the child reaching maturity (18).

Can the courts terminate parental rights for failing to pay child support in Hawaii?

Although a different topic entirely, it is vital to remember that the courts can terminate parental rights if the parent deserts the child without affording means of identification for at least 30 days. Additionally, if you voluntarily surrender custody of the child to another for two years, your parental rights may be revoked.

Furthermore, your parental responsibility may be terminated if:

- You fail to communicate with the child for at least one year.

- When you fail to provide support and care for at least one year.

- If you are found mentally or physically incapable of taking care of the child.

- Parents who are found unfit as per the guidelines.

- Proof of sexual abuse is presented.

How long do you have to pay child support in Hawaii?

Hawaii child support guidelines place the age of emancipation at 18, however, this limit may be extended up to 23 if the child is enrolled full time in an accredited university or college. Furthermore, support may continue indefinitely if the child is mentally or physically disabled.

Remember “unusual circumstances” may further extend your parental obligation.

One way to end child support early in Hawaii is emancipation. Emancipation frees the parents from any financial or emotional obligation owed to the child, meaning, once it is done, you may lose all access to your child.

If you are over 16, you are eligible for emancipation in Hawaii. But it must be done with the approval of your parent and you must demonstrate to the court that you are financially capable of taking care of yourself. Another option is to get married.

All in all, Hawaii child support guidelines can be problematic to navigate on your own, thus we recommend that you work closely with a family court attorney to better understand your court-ordered parental obligation, and your parental rights. On top of that, the court often makes the final decisions, meaning, results are not always uniform. If you need to consult with an attorney for additional info, you can get a free consultation with a local attorney here.

More Hawaii Laws