Colorado child support laws dictate the rights and obligations of caregivers; however, the intricacies of these guidelines can get a little confusing especially when it comes to calculating your parental obligation. For example, did you know that the state’s “parental obligation formula” is based on what the family would have theoretically spent on the child if the parties had not separated? The reason for that, plus plenty more will be explained in 5 minutes or less.

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a lawyer here.

- How is Child Support Calculated in Colorado?

- Colorado Child Support Guidelines for High- and Low-Income Earners

- What does Child Support Cover in Colorado?

- What happens if you don’t pay child support in Colorado?

- How much can Child Support take from Unemployment in Colorado?

- Does Child Support Automatically Stop at 19 in Colorado?

How is Child Support Calculated in Colorado?

In Colorado, child support is a percentage of the combined gross income of both parents. Thus, unlike Arkansas (link to Arkansas) that uses the “percentage of obligor income” model, the state uses the “income shares model” when awarding child support. That means your incomes, no matter the source, are combined then the court decides an appropriate amount.

The version of the income shares model the state uses is appropriately named “child support guidelines”. This guideline takes into account:

- How much time each parent spends with the child or kids.

- Total income from all sources including wages, salaries, tips, pensions, overtime, unemployment, social security, and so on.

- Child care costs such as daycare.

- Health insurance

For one child, the percentage is typically 20% of the combined gross income. If there are any additional kids, you will have to pay 10% for each.

Overall, Colorado child support laws work under the presumption that whether parents are together or split, they both owe their kids financial support to cover needs including, education, clothing, and food. Furthermore, the amount you pay is theoretically supposed to be the same amount you’d spend if you and your partner stayed together. The important piece of information to remember is, in Colorado, child support is owed to the child or children, not your former partner. This is important to remember because your level of income will dictate how much you owe.

Colorado Child Support Guidelines for High- and Low-Income Earners

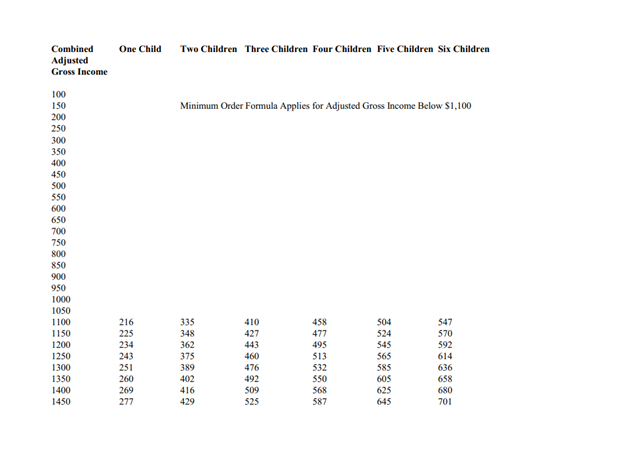

The pdf above is a reference table that provides parental financial obligation estimates for parents who earn $100 to $30,000 a month. Here is the important part, C.R.S 14-14-115, provides for a presumptive amount of support, meaning, if you earn less than $1100 a month, your minimum obligation is:

- $50 for one child.

- $70 for two.

- $90 for three.

Note that child support minimum in Colorado can apply to one or both parents.

For high income earners, C.R.S 14-10-115 (7)(a)(ii) (E) states quote:

“the judge may use discretion to determine child support in circumstances where combined adjusted gross income exceeds the upmost levels of the schedule of basic support obligations: except that the presumptive basic child support obligation shall not be less than it would be based on the highest level of adjusted gross income outlined in the schedule of basic child support obligation”.

What this means for high-income earners is, if your combined income exceeds $30,000 a month. Child support will be determined by the court based on the child’s reasonable needs. Meaning, in some instances you may have to pay more than the guidelines dictate.

Whether you are a high-income earner or low-income earner. One fact remains, child support is an obligation that must be paid. This raises the question:

What happens if you don’t pay child support in Colorado?

Before we answer this question, we must first ask,

What does Child Support Cover in Colorado?

CSS (Child Support Services) is the body responsible for enforcing child support in Colorado. According to them, child support is based on:

- Financial resources and needs of the non-custodial parent.

- The standard of living the child would have enjoyed.

- Physical, emotional, and educational needs of the child.

- Custodial parent’s financial resources.

- Financial resources of the child.

Notice that the non-custodial parent’s rights are protected.

This brings us back to the question:

What happens if you don’t pay child support in Colorado?

Failure to pay child support can result in two outcomes in Colorado. One, the CSS may decide to take forceful measures such as intercepting tax refunds or garnishing wages. Two, your case may be referred to court. If the latter happens, the charge you will face is “contempt of court”.

Contempt of court in matters child support can either be treated as a misdemeanor or a felony.

What happens if I’m found in contempt?

A citation and motion of failure to pay child support will be issued, if this is ignored, a bench warrant will be issued. Consequently, a warrant of arrest will be issued against you, meaning, if you find yourself in the hands of the law in say a traffic stop or whatever encounter, the officer will see the warrant of arrest and place you under custody.

Being shadowed by an arrest warrant is not a comfortable position to be in, so the best course of action is to contact an attorney and quash the warrant as soon as possible. Remember, failing to clear your warrant means that you are subject to arrest and jail at any time!

Penalties for not paying child support in Colorado

Willful failure to pay child support will trigger the following enforcement actions:

- Tax offsets.

- Credit bureau reporting.

- Lottery winning intercept.

- Professional, social, or driver license suspension.

- Deductions from unemployment benefits and worker’s compensation.

- Wage garnishment.

- Gambling winning

- Personal property may be sold.

- Liens on vehicles and other expensive items.

- Asset garnishment such as bank account or property.

Remember, CSS is authorized to use these enforcement actions and more if you fail to pay alimony. So, if you find yourself unable to pay, contact a local office as soon as you can preferably before a warrant is issued.

Additional Reading: CPS Case Laws – How long does a CPS conviction stay on your record?

When Does Failing to Pay Child Support Become a Felony in Colorado?

Felony charges depend on the amount of unpaid child support in question and how much time has passed since you made the last payment. Additionally, if you leave the state intentionally to avoid paying, you may face federal charges.

How much can Child Support take from Unemployment in Colorado?

Colorado child support laws define unemployment in two ways, one is involuntary unemployment and two, voluntary underemployment.

In 2003, the Colorado supreme court issued this:

“trial courts must examine all relevant factors bearing on whether the parent is shirking his or her child support obligation by unreasonably foregoing higher-paying employment that he or she can reasonably earn and contribute to the child’s support. If the trial courts do not find that the parent is shirking his or her child support obligation by un-reasonably foregoing higher paying employment, they should calculate the amount of child support starting from actual gross income only”.

Furthermore, CRS 14-10-115 (b) (I), provides that child support has to be calculated based on the determination of potential income. The only exception is a parent, or parents who are mentally or physically incapacitated or one who is caring for a child under 30 months for whom the parents owe a joint legal responsibility or for an incarcerated parent.

That means, if you don’t have a job, the court will use “potential income” to determine your financial obligation.

What is Involuntary Unemployment?

If you are unable to work because of physical or mental incapacity, or if you lose your job. The court considers you involuntarily unemployed, meaning, it is highly unlikely that your income will be imputed.

One the other hand, voluntary unemployment or underemployment is when you make less than diligent efforts to secure a job or when you intentionally avoid employment, cut back on work hours, quit a profession to work as hourly labor, and so on.

If the court finds that you intentionally avoid getting a job. the court will look at the unique facts and impute the amount from your former earning level.

Note that the court allows you to challenge imputed income decisions. To that end, what you must do is provide sufficient evidence that you are actively looking for a job.

Does Child Support Automatically Stop at 19 in Colorado?

19 is the legal age of emancipation in Colorado, but there are some exceptions to this rule that may extend or shorten child support. On top of that, some cases require court approval before you stop paying.

So, in theory, payments should cease on your son’s or daughter’s 19th birthday. However, if the 19-year-old is still in high school. Colorado child support laws say you must continue paying until the end of the month of graduation or when the child turns 21.

conversely, if the child is 19 and drops out of high school, you no longer have to pay child support. But remember, payments don’t cease automatically, thus you have to seek a support modification and contact the custodial parent or CSS to end your obligation. Talk to a Family attorney.

What if the child has a disability?

In this scenario, child support may be a lifelong obligation, but the court has to find a reasonable justification for continued payments.

That said.

If the child joins the military, gets married, moves out, and finds a stable source of income, then your support obligation can end early.

Next Steps

If you feel that you need to talk to a lawyer about your specific situation, you can contact one for free here.

More Colorado Laws