Everything you need to know about Rhode Island child support laws, updated for 2020.

Under Rhode Island Child Support Laws, divorced, separated, or parents, in general, have a legal responsibility to provide upkeep until the child reaches the age of majority.

Between now and the time your child turns 18. The needs of your family will change in a lot of ways. For example, the child might need college tuition, you might lose your job, or maybe your former partner might choose to abandon his/her parental responsibilities. So, the question is. How does child support work in Rhode Island? What guarantees that your former partner will pay?

How does the judge decide the amount you owe?

And what can you do if your ex refuses to pay?

Find all the answers below.

How to apply for child support in Rhode Island

The DHS (Department of Human Services) through Rhode Island’s Office of Child Support Services (OCSS) offers parents in the state services including paternity establishment, child support order establishment and enforcement, and all child related services.

Currently, due to COVID-19, the department offers online services to lower the number of in-person applicants.

That said.

To apply for support services, you must download the child support application form here or call (401) 458-4400.

What to remember:

- Parents who have suffered domestic abuse must complete the Family Violence Questionnaire.

- The application service fee is $20.

- Parents receiving RI work benefits or Rite care Benefits need not apply for services. They qualify for support services automatically.

- When applying for support, you will need the names of both parents, last known whereabouts, social security numbers, both parents’ income information, your ID, divorce papers, birth certificate, and paternity affidavit. Because the more information you provide, the faster the DHS will process your order.

How to establish paternity in Rhode Island

Rhode Island Child support Laws say that parents can establish paternity voluntarily or involuntarily. What that means is if you sign the “voluntary Acknowledgement of Paternity” (VOP) form at the hospital or support service offices. Then the law assumes that you are the father.

On the other hand, the involuntary establishment of paternity happens when the court issues an “order of paternity” requiring the parent to take a genetic, blood, or DNA test.

What to remember:

- If the results of a court-ordered DNA test turn positive, the father must reimburse the $200 DNA service fee.

- The court will add the father’s name to the child’s birth certificate if the test is positive.

- Paternity establishment grants the father rights including, visitation and custody. The child gets inheritance rights and the receiving parent less parental burden.

- The child may also benefit from the father’s life or medical insurance cover.

- Rhode island’s office of support services can file a complaint naming the accused man as the father until he signs the VOP form or a DNA test proves otherwise.

- Fathers in the state must file a motion for visitation/ custody at the family court to gain visitation rights.

- The statute of limitations on paternity establishment is-4 years after the child reaches the age of majority.

How to Calculate child support in Rhode Island

In 2018, Rhode Island Adopted the “Income Shares Model” to determine parental weekly support. Because of that, judges in the state calculate child support following the steps listed below:

- Determine the weekly gross income(s) of both parents before deductions or taxes. ‘Gross income’ in the state encapsulates worker’s compensation, salary, wages, disability benefits, and all sources of income excluding, benefits the parents receive from Rhode Island’s Family Independence Program.

- Mandatory deductions: from the parent’s income, the judge deducts health insurance premiums, preexisting child support payments, cost of child care, and support for additional children.

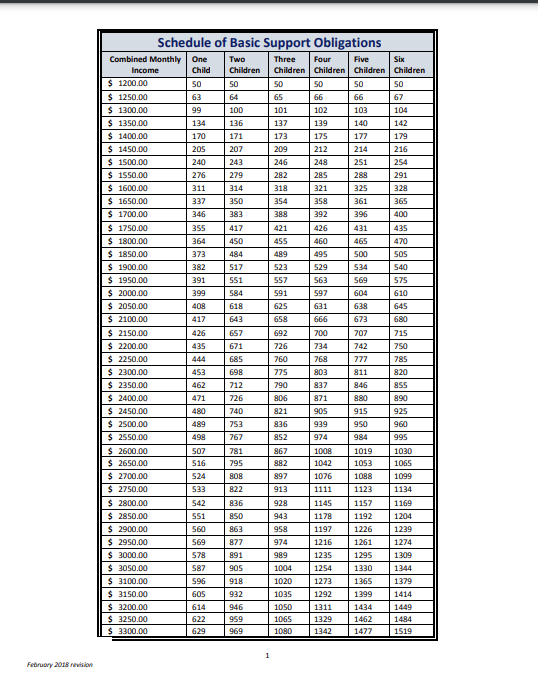

- Combine the adjusted gross incomes of both parents, then find the resulting amount on the State’s Child Support Guideline Chart. See the snippet below.

- Determine the parental percentage share.

Child Support Guideline Chart.

Download Rhode Island Child support Guideline chart here.

What is crucial to remember is that the non-custodial parent pays the set weekly amount via wage withholding. Meaning, your employer will garnish child support directly from your salary or wages.

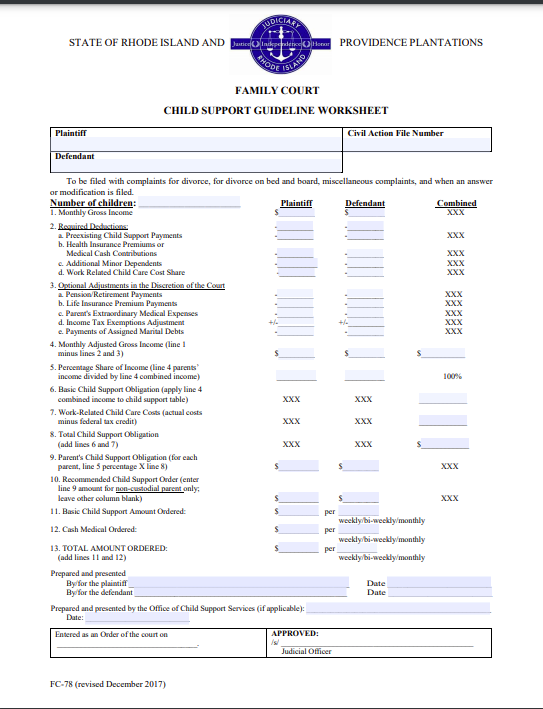

An easier way to estimate your obligation is to use the one page Rhode Island Family Court Child support Guideline Worksheet here.

Rhode Island Family Court Child support Guideline Worksheet

You may also access other child support tools/forms here or consult with a family court attorney for better accuracy.

How to modify child support in Rhode Island

Although Rhode Island Child Support Laws allow parents to petition for order changes, the petitioning party must show a “Substantial change in Circumstances”. A substantial change in circumstances refers to any scenario that negatively impacts your earning capacity. For example, disease, job loss, change of custody, and so on.

However, voluntary job loss or voluntary underemployment does not constitute a change in circumstances because the law assumes that you are capable of working.

To begin the modification process, you must:

- Custodial parents must download and complete the Custodial Parent Request for Modification form.

- Non-custodial parents must complete Motion For Relief As a Self- Represented Litigant.

- OR, the Non-Custodial Request for Relief Form.

Download all modification forms here.

What to remember:

- Either party may petition for support order changes three years after order establishment or review.

- To win modification before the three-year waiting period elapses, the petitioning parent must show a substantial and continuing change in financial circumstances.

- Incarcerated parents can petition for modification via video conferencing.

- The OCSS, through the RI Department of Labor, provides programs to help parents improve their skills or secure employment.

- Rhode Island child support laws require at least a 10% change for the court or OCSS to grant modification.

Grounds for child support order modification in Rhode Island

It is essential to realize that when petitioning for modification, there can only be two outcomes, that is, approval or denial. To increase your chances of landing an approval, you must show the courts:

- An increase or decrease in the other parent’s income.

- Involuntary unemployment, reduced work hours, or extraordinary expenses required to keep your business afloat.

- Increase or decrease in daycare costs, medical or dental insurance, or the addition of new dependents into the home.

These are just examples, so consult with a family court attorney in your area to see if your situation applies.

What happens if you do not pay child support in Rhode Island?

According to the OCSS, the biggest mistake parents paying child support in Rhode Island make is failing to petition for modification when the situation warrants changes. For example, due to the ongoing pandemic. Not all parents who have lost their jobs or seen a decrease in their incomes have petitioned for modification.

The issue is child support is a legal obligation, meaning failing to pay is a violation of Rhode Island child support laws.

Failure to pay child support is a punishable offense that might prompt the court or OCSS to use enforcement tools such as:

- Passport denial

- Financial/institution/bank data match

- Lottery interception

- Administrative liens

- Insurance proceeds intercept

- Drivers, recreational, or professional license suspension.

- Civil warrants for arrest

The OCSS or court may also charge interest at 12% annually on back child support.

Criminal non-support in Rhode Island

Title 11 Criminal Offenses, R1 Gen L 11-2-1.1 (2014) reads, quote:

“Every person who is obligated to pay child support pursuant to an order or decree established by or registered with the family court pursuant to chapter 11 of title 15, who has incurred arrearage of past-due child support in the amount of ten thousand dollars ($10,000), and who shall willfully thereafter, having the means to do so, fail to pay three (3) or more installments of child support in an amount previously set by the court, according to the terms previously set by the court, shall be guilty of a felony for each instance of failure to make the subsequent payments and upon conviction shall be punished by imprisonment for a period not to exceed five (5) years.”

What that means is, If the amount of back support a parent owe surpasses $10000, or if you fail to provide support for at least 3 years. You may face felony criminal non-support charges.

Being a felony, willful failure to provide support carries a maximum sentence of five years. The court may also order a fine, or community service depending on the nature of the delinquency.

What to remember:

- Tax refund interception happens when the paying parent owes at least $25.

- If the amount of back support owed surpasses $2500, the OCSS or court may deny or revoke the parent’s passport.

When does child support end in Rhode Island?

In Rhode Island, child support ends when the child turns 18. However, child support order termination is not automatic. Meaning, you must contact the OCSS or court where you got your order before the child’s 18th birthday.

Also, child support may continue if the parents made a binding agreement to provide higher education tuition. Your support order may also continue up to 21 or indefinitely if the child is mentally or physically disabled.

Emancipation laws in Rhode Island

In Rhode Island, there is no formal emancipation statute or process, but your obligation may end early if the child joins the army or gets married.

More Rhode Island Laws