Everything you need to know about Nebraska child support laws, updated for 2022.

The main principle behind the Nebraska Child Support Guidelines is that parents in the state share an equal duty to contribute to the support of their child(ren) in proportion to their respective incomes.

§ 4-201. Introduction

That tells us that the law puts the best interests of the child first. But what about your rights? What if you are paying too much or receiving too little? We answer these questions and all other relevant child support questions.

How to apply for child support in Nebraska

The Nebraska Department of Health and Human Services (DHHS) handles child support cases in the state. The department also offers services including locating parents, paternity establishment, the establishment of court orders, modifying child support orders upon request, and enforcing child support orders.

To apply for services, follow this link or call 877-631-997.

The process should take at most 20 minutes, and you will need a copy of your child support court order if established, your children’s health insurance policy information, and your social security numbers.

Another option is to contact a family court attorney in your county or visit local offices.

Note that if you hire an attorney, the DHHS will work through him or her.

How is child support calculated in Nebraska?

Article 2 child support guidelines 4-209, Says that minimum support in Nebraska is $50 or 10% of the obligor’s net income. The only exception is when a parent is either incarcerated or disabled.

That said.

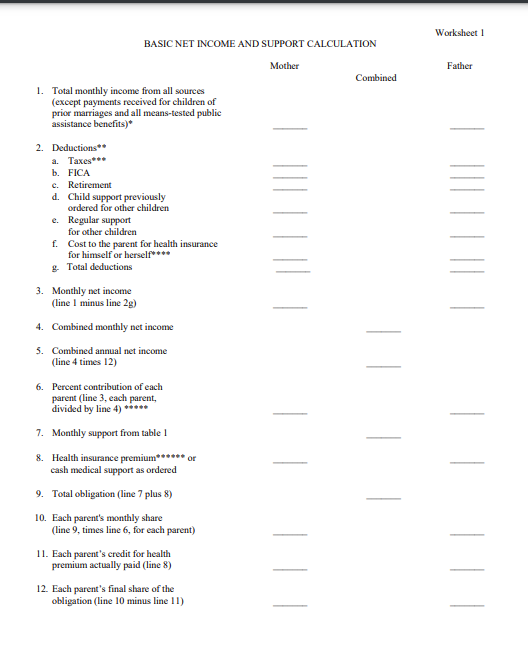

To calculate parental share, Nebraska courts provide a worksheet.

Download the Basic Net Income and Support worksheet here.

How does Nebraska calculate child support?

Nebraska uses the “income share formula” in awarding child support. What that means is the judge considers the incomes of both parents when distributing obligation.

On February 4th, 2020, Nebraska child support guidelines changed.

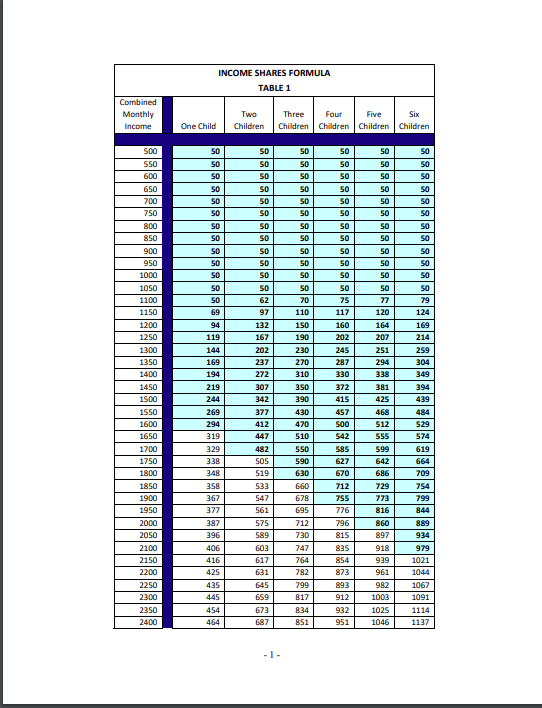

The changes introduced include a new Income Shares Formula table (see snippet below) and the changes below.

Download the complete table here.

The idea is, use the worksheet to establish your parental share. Then find the closest figure on the table.

Further changes to Nebraska child support guidelines:

- The courts now consider a parent’s earning capacity rather than his or her actual income in cases where the caregiver is underemployed or voluntarily unemployed.

- The total combined income from both parents has gone up from $15000 to $20000. But the judge may order an amount higher than that.

- Uninsured medical expenses dropped from $480 to $250.

- If the judge orders cash medical support, the amount is now 5% from the previous 3%.

What to remember:

- Net income in Nebraska means your income minus deductions such as mandatory retirement plans, income taxes, and so on.

- Voluntary unemployment prompts the judge to impute income (decide an amount based on what you would make if employed).

- Both parents must contribute to child (ren) insurance, child-rearing costs, and health insurance.

- In joint custody cases, the judge employs worksheet 2, and if time is shared equally, the judge uses worksheet 3 to determine parental obligation.

Therefore, to calculate child support, the judge will follow the steps listed below.

- Combine the monthly incomes of both parents.

- To establish monthly net income, the court deducts taxes, FICA, mandatory retirement benefits, health insurance, existing child support orders, and all other deductions as per Nebraska child support guidelines.

- Compare the resulting figure to table 1.

- then multiply the child support amount by the percentage contribution of each parent relative to income.

How do I modify support in Nebraska?

Federal law allows parents in Nebraska to request a child support review every three years.

Accordingly, if you feel that the court-ordered amount is unfair, call (877) 631-9973.

Conversely, if unsure whether you qualify for a modification, consult with a family court attorney in your area.

Click here to request a review.

What is important to remember is, the county or child support department will not review upkeep order unless three years have subsided since issuance. The only exceptions for modification before the three years have elapsed are:

- The petitioning party demonstrates a substantial and continuing change in circumstances lasting at least three months.

- The existing order does not cover health care.

- If the children do not have health coverage other than the Medical Assistance Program Under the Medical Assistance act.

- If the amount violates Nebraska child support guidelines or is unfair.

Note that voluntary unemployment and underemployment are not grounds for modification in Nebraska.

What to remember:

- Article 2. 4-219 reads, quote, “under no circumstances shall there be an increase in support due from the obligor solely because of an increase in the income of the obligee.”

- Birth and Adoption or acknowledgment of subsequent children (obligor) alone are not grounds for support reduction.

- The petitioning parent must demonstrate a substantial change in financial circumstances.

Do not forget that each case is different, so consult with an attorney to see if you qualify.

What happens if you do not pay child support in Nebraska?

In Nebraska, each district has its own sets of rules. So, if you are facing charges, we advise you to visit your local child support office.

That said. In Nebraska, the CSE (Child Support Enforcement), a branch of the DHHS, is responsible for child support order enforcement. The tools this department uses are:

- Income withholding: if an income withholding order is issued, your employer will garnish child support directly from your wages, salary, or income in general.

- Credit bureau reporting: the CSE can also forward the delinquent parent’s information to credit bureaus impacting his/her finances.

- License suspension: license suspension is employed if the parent owes more than three months of back support.

- Travel restriction: the US state department revokes or denies passport to parents who owe more than $2500.

- Bank account garnishment.

- Liens against property: liens placed against cars, homes, or valuable property last until the parent settles the amount owed.

- Auctioning private property: the CSE can take your property and sell it.

- Charge interest on arrears.

Non-support contempt charges in Nebraska

Contempt of court is a punishable offense that happens when you disobey a court order. When facing such charges, the at-fault party appears in court to defend his/her position.

If the excuse for child support non-payment is not worthwhile, the punishment is either jail, a fine, or both.

For custodial parents, complete this form to start contempt proceedings. On the other hand, non-custodial parents should consider contacting the CSE, court, or former partner if your circumstances do not permit payments.

The idea is to solve the issue via modification before it escalates.

When does child support non-payment become a felony in Nebraska?

In Nebraska, criminal non-support is a crime that occurs when any parent fails, refuses, or neglects his/her obligation to support the child. For example, refusal to pay hospital costs.

Do not forget that criminal non-support is a class iv felony charge in the state. Meaning, you risk time behind bars, a fine, or both.

But the good news is jail is often the last course of action, and all collection actions are preventable by honoring your obligation.

Is there a statute of limitations on back child support in Nebraska?

There is not. Hence, the ghost of child support will shadow you until you pay.

And, it is not the CSE’s job to monitor how the custodial parent spends court-ordered support.

How long does child support last in Nebraska?

Unless determined otherwise in your child support order, the age of emancipation in Nebraska is 19. But you or the child can end your obligation early.

Option 1: voluntary termination of parental rights

Nebraska revised statute 43-292 says that if a parent is unable to honor parental obligation because of a mental illness, he or she can petition the court to terminate child support.

Remember, the guiding principle is the best interests of the child. Meaning, termination happens if the parent is unfit to raise the child. Also, the judge may strip your parental rights involuntarily if the other parent or states proves:

- The parent committed murder or felony, sexual assault.

- Inflicted injury upon the child.

- The parent participates in Debauchery, drug use, or alcoholism.

- The parent abandons the child.

Option 2: emancipation

When a child gets emancipated, it means that in the eyes of the law, that child is an adult but not with adult privileges such as drinking, gambling, tobacco use, etc. That means you can move out at 16 in Nebraska only if:

- You are 16, financially independent, and live separately from your parents.

- Mature, knowledgeable, and can manage your affairs without parental assistance.

- Demonstrate your commitment to getting employment, education, or vocational training.

Remember, the primary consideration for emancipation is the best interests of the child. Thus, it is up to the judge to decide to award or disapprove an application.

More Nebraska Laws