Everything you need to know about Montana child support laws, updated for 2020.

Montana child support laws require that the awarded upkeep amount must be adequate and reasonable.

But… and that is a huge one. In the state, every case is determined based on merit and circumstances. What does this mean for your relationship with your child and former partner?

Time to find out. But before we begin, we must cover the basics.

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

How to apply for child support in Montana

In Montana, the DPHHS (Department of Public Health & Human Services ) is the body tasked with locating parents, establishing paternity, child support, and medical orders, and modification of child support orders.

What that means is, to apply for services either visit local offices (see regional offices here) or call (800) 346-5437.

What to remember:

- Legal paternity must be determined before a child support order is issued.

- Montana Child Support Guidelines dictate the amount ordered.

- There are set timeframes in requesting a hearing, thus you must read your child support notice carefully.

- All support orders in Montana contain a provision for medical support.

How is paternity established in Montana?

Montana Child Support Guidelines require both parents to support the child(ren) whether married or unmarried. That rule also applies to unplanned pregnancies.

Stemming from that are the rights and needs of the child(ren). What do I mean?

Under state law, children in Montana have a right to know their parents, and they also have the right to know if they inherited any health problems.

That means paternity establishment is vital. But how is paternity established?

In Montana, paternity is established via voluntary paternity acknowledgment (see form linked), court adjudication, genetic testing, and ‘presumed paternity’. Presumed paternity refers to a situation where a child is born during a marriage or three hundred days after divorce, death, or annulment.

Also, the DPHHS maintains a ‘Putative father registry’ that makes it easier to track down parents.

How is child support calculated in Montana?

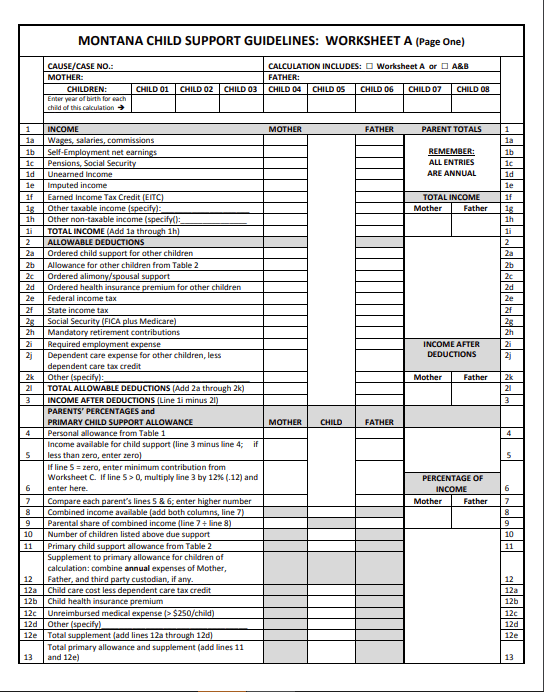

When calculating child support, the judge or overseeing body utilizes a five-page worksheet (see the snippet below).

Page 1: Montana child support worksheet

Download the full worksheet here.

Download worksheet instructions here.

Note: The amount that results is dependent on your input, so the figure you get might be very close or very far from what the court settles on.

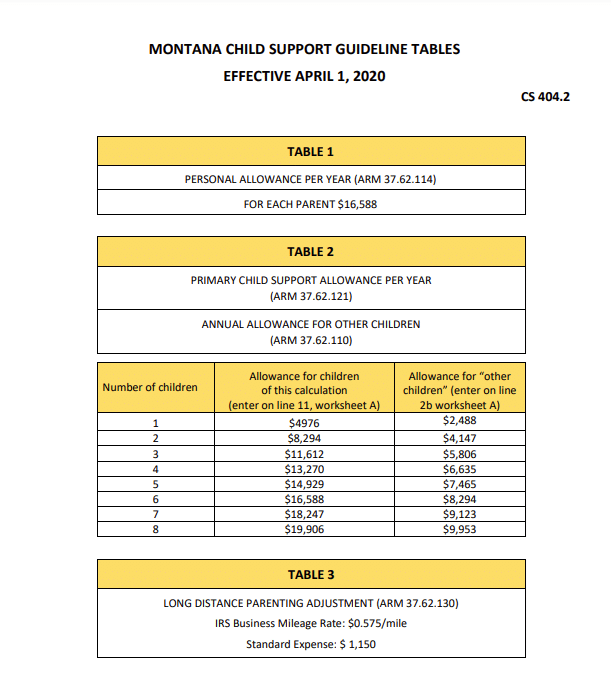

On April 1, 2020, Montana introduced a new child support table CS404.2.

Montana child support guidelines table

According to Mont. CODE ANN. 40-4-204. Marital misconduct is not a factor when awarding support. Also, the factors that determine parental obligations are:

- The financial resources of the parents and child (ren).

- The standard of living the child(ren) would have enjoyed if the parents stayed together.

- Emotional, medical, and educational needs of the child(ren).

- Cost of daycare and the age of the child.

- Any existing court-ordered parenting plans.

- The needs of any person the parent is legally obligated to support.

How is child support determined in Montana?

Montana Child Support Formula considers the income(s) of both parents. Depending on the specifics of your case, the court may use the joint custody formula or the sole custody formula.

In sole custody cases, the factors considered are:

- Incomes of both parents.

- Time spent with the child.

- All other considerations as per Montana Child Support guidelines.

Whereas, in joint custody cases, time spent with the child is the main consideration. The point is, the more time you spend with the child, the lower your obligation will be.

What to remember:

- Montana does not use the Income Share Method nor the Percentage of Income Method. (Use the worksheet linked above.)

- The more time you have custody of the child, the lower your obligations will be.

- Extraordinary medical costs such as braces, hospital visits, and so on are “mandatory deductions” in Montana.

- Care costs and general costs of raising a child are not the same under Montana child support guidelines.

- Montana child support guidelines do not have an explicit requirement for college expenses. Such agreements can be made out-of-court.

How to modify child support in Montana

According to the CSSD (Child Support Services Department), parents in Montana can order a review of existing orders 36 months after the order was established or reviewed.

To request modification before the 36 months is up, the parent must demonstrate to the court “a significant and ongoing change in circumstances”. What is a significant change in circumstances?

State law identifies four scenarios:

One, when the physical custody of the child changes. Two, an increase in the cost of daycare or medical expenses. Three, new children. Four, 30% income change (increase/decrease).

Child support modification steps:

- Contact the investigator assigned to your case.

- Submit a request for a review packet obtained from the investigator.

Remember that if neither parent contacts the CSSD, the court finalizes the order by default following the terms of the notice.

Find all legal forms here or call 1-800-666-6899.

What to remember:

- Each parent can request or file a modification request.

- The judge does not consider new spouse’s income when awarding modifications.

- Stepparents do not have to support children from a previous union.

Overall, if you feel that your child support order is unfair, contact a family court attorney in your area.

What happens if you do not pay child support in Montana?

CSED (Child Support Enforcement Department) is a separate unit that exists within the DPHHS. The work of this department is to enforce child support on federal or at the state level using the listed remedies:

- Consumer bureau reporting: CSED can report delinquent parents to credit bureaus, this action will affect your mortgage, credit score, and your finances in general.

- Income withholding: income withholding notices require employers to garnish child support at the source (wages, bonuses, salaries, and so on).

- Federal and state income tax interception: the CSED can take part or all your returns to cover child support.

- If the amount of back support exceeds six months, CSED can suspend the delinquent parent’s recreational, professional, or driver’s license.

Note: The go-to method of collection is income withholding because it guarantees timely payments.

Civil contempt: failure to pay child support

If the paying parent fails to honor his/her obligation, Montana Code Annotated 2019, part 6, 40-5-601, says the receiving parent can petition the court to find the obligated person in contempt of court.

What does that mean?

section 9 of the bill reads, quote,

“if the obligated person is not excused under section (7) and (8), the district court shall find the obligate person in contempt of the support order. For each failure to pay support under that follows, the court shall order punishment as follows:

One, Not more than 5 days incarceration in the county jail. Two, not more than 120 hours of community service. Three, not more than a $500 fine”.

To clarify, subsection 7 says that parents can prevent contempt charges by showing clear and convincing evidence that he or she has insufficient income to pay arrearages or provide another reasonable excuse as per Montana child support guidelines.

Is there a statute of limitations on child support in Montana?

According to Montana child support guidelines MCA 27-2-201 (3),

“The period prescribed for the commencement of an action to collect past due child support that has accrued after October 1, 1993, under an order entered by a court of record or administrative authority is within 10 years of the termination of support obligation or within 10 years from entry of a lump-sum judgment or order for support arrears, whichever is later.”

When does child support end in Montana?

State law requires parents to pay child support until the child graduates’ high school or turns 18 but no later than 19.

However, payments may continue past 18 if the child is mentally or physically disabled.

Voluntary termination of parental rights

Montana Child Support Laws allow caregivers to voluntarily give up their parental rights for an adoption to happen. Alternatively, the child can choose emancipation.

Emancipation is an option that frees up the child from his/her parents.

To qualify for emancipation the law requires that the child be at least 16 years of age, financially independent, and his/her income must be legal.

Download emancipation petition forms here.

Overall, if all factors remain constant, your child support order will terminate on your child’s 18th birthday. If you are supporting multiple kids, you should petition for modification when one reaches the age of majority. Doing that will lower your obligation.

Generally, if you have additional questions about child support in Montana we would advise you to get a free case consultation with a local lawyer.

More Montana Laws