Everything you need to know about Missouri child support laws, updated for 2020.

Proper understanding of Missouri Child Support Guidelines is essential to all parents in the state in that it helps you identify your rights and obligations.

However, gaining knowledge from the State Statutes is bothersome and tedious. But today, we will tell you all the vital bits in Title XXX Domestic Relations and all the laws that concern you, your spouse or ex, and the kids from the relationship.

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

How to apply for child support in Missouri

The Missouri Department of Social Services handles child support cases in the state.

So, if you are struggling and need support, download and complete the linked form, then mail it to the Family Support Division or locate a child support office in your area here.

What to remember:

- Non-custodial parents pay a $25 fee if the payments total $500 or more during a federal fiscal year (October 1st to September 30th).

- Application for services is either done online or at your nearest child support office.

- To complete the linked form (Application for child support service), you will need your social security number, addresses, court order information, or any other document that applies.

Are you the putative father or the father?

The state of Missouri keeps Putative Father records detailing the names and addresses of fathers who believe they might be the father. That means, if you believe that you are the father and paternity is unknown, the law allows you to put your name in the registry so that it will be easier to track down your ex or baby mama.

Also, this service prevents adoption without consent, and it gives you peace of mind.

To apply, you must file a “notice of intent to claim paternity” at the Bureau of Vital Records.

In Missouri, paternity is established voluntarily by signing or completing an affidavit acknowledging paternity at the hospital. This tells you that you should never sign any binding contracts if paternity is uncertain.

The other method of paternity establishment is via the court or FSD action.

How is child support calculated in Missouri?

Missouri revised statute section 452.340 features Missouri Child Support Guidelines. These guidelines dictate court action, parental responsibilities, and the rights of a child.

What is important to remember is, when calculating child support, the judge or enforcing body bases the amount on the incomes of both parents.

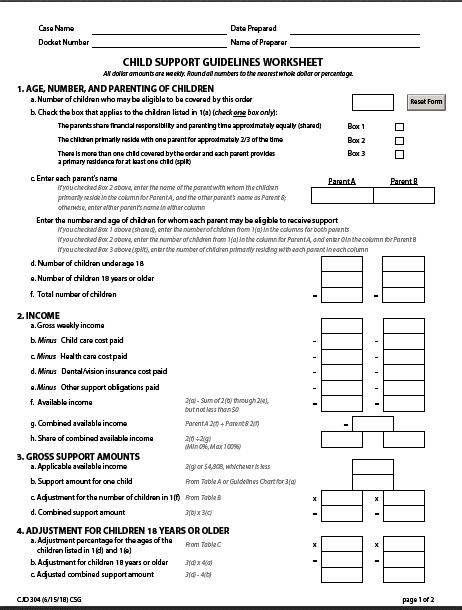

To aid estimation, Missouri courts provide a worksheet.

Missouri child support worksheet

Download the worksheet here or here if the state website is down.

Remember that the figure you get depends on your input. Therefore, it is vital to talk about the considerations that go into a child support order in Missouri.

How is child support determined in Missouri?

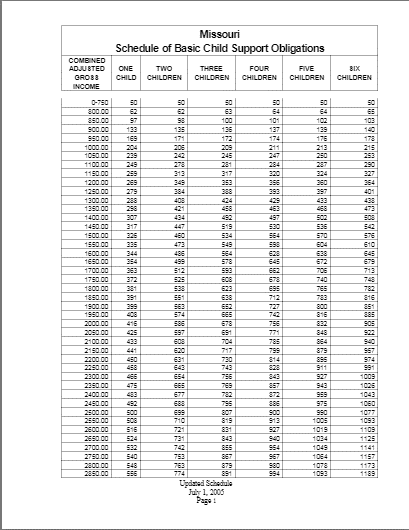

Along with the worksheet, the judge utilizes the State Schedule of Basic Support calculations. How does it come together?

Missouri state schedule of basic support chart.

First, the deciding party uses the worksheet, then compares the amount to the chart in the snippet below to determine parental obligation. Note that the results are not always accurate, so consult with a family court attorney in your area for better estimates.

That said.

Child support is determined in Missouri following the steps listed below.

- Combine the monthly gross incomes of both parents (wages, salaries, social security benefits, and so on).

- Calculate basic child support based on the combined incomes.

- The judge awards child support based on parents’ proportionate share of income.

That is the simplified version.

What is important to remember is, according to chapter 452 Domestic relations, relevant factors considered when awarding child support include:

- Reasonable work-related child-care expenses of each parent.

- The financial needs and resources of the child.

- The standard of living the child would enjoy if the parents never split.

- The child’s emotional and physical needs.

All this boils down to two steps:

- Use the Missouri child support worksheet/ civil procedure form #14.

- Compare the resulting figure to the Missouri Schedule of the Basic Support Chart.

You may use the long method, but that is tedious and confusing.

How to modify child support in Missouri

State law recognizes that the needs of a child change as he or she marches to maturity. That is also true for parents, this raises the question. Is it possible to lower my obligation?

In Missouri, Child Support Modifications can go either way, meaning, the judge may order you to raise or lower your monthly support. But that does not mean that the amount awarded is always appropriate. Because of that, Missouri child support guidelines require parents petitioning for modification to prove that the changes you seek are in the best interests of the child and not out of desire.

To begin the process, download and complete form CAFC102- motion to modify.

Grounds for child support modification in Missouri

- 20% change in parental income (increase/decrease).

- Or a “Substantial and continuing change in circumstances”.

Things to note when modifying child support

- Stepparents’ income is different from parental income.

- Stepparents can seek reimbursement for money paid to support the stepchild.

- Remarriage does not affect your child support order.

- Substantial and continuing change captures life-altering illnesses, incarceration, or any circumstance that impacts your finances.

- Modifications are made in court or out of court via parental agreement or mediation.

Acknowledging that circumstances are not uniform, we advise you to consult with a family court attorney in your county if you feel that your support order is unfair.

What happens if you do not pay child support in Missouri?

Failure to pay child support is a punishable offense across all states. In Missouri, Missouri Family Support Division (FSD) is the body responsible for enforcing Missouri child support guidelines.

In its arsenal, the division has several remedies used to strong-arm parents into paying their parental obligations. These solutions include:

- Wage garnishment/withholding: when such an order is issued against a parent, his/her employer must withhold a set amount from the paying parent’s wages, or salary.

- Liens on property: liens serve to guarantee payments by acting as security and thus may keep you from selling your home, car, or other valuables until you pay child support.

- Benefits withholding: the FSD can withhold your tax returns, lottery winnings, and unemployment.

- Credit bureau reporting: this option may hinder your mortgage, tank your credit score, and make securing employment problematic.

- License suspension: your drivers, professional or recreational license is subject to revocation, or suspension.

Civil contempt charges Missouri

“contempt of court charges” in most states require the accused party to appear in court to defend his/her actions. What is important to remember is:

- Collection actions are preventable by honoring your obligation.

- If the excuse for nonpayment is solid, a new arrangement may come into play via modification.

- There may be multiple hearings.

- Jail time is a possibility if your excuse does not hold water.

Missouri Back Child Support Laws

When does back child support non-payment become a felony in Missouri?

In Missouri, twelve months’ worth of back child support is a class E felony, whereas, criminal non-support is a class A misdemeanor. A class A misdemeanor carries a $2000 fine or anywhere from one day in jail to one year.

Although a class E felony is the least severe class of felonies, the punishment is either a $10000 fine or a maximum sentence of four years.

Is there a statute of limitations on child support in Missouri?

According to Missouri child support guidelines, the statute of limitations on upkeep is ten years from the last payment on-court record. On the other hand, the limitation on paternity determination is the child’s 21st birthday if he or she is the petitioner or on the 18th birthday if a parent is petitioning.

Child Support Arrears Forgiveness Missouri

Missouri law only allows child support modifications, not forgiveness. That means, even if you get your former partner to agree to forgive the debt, the state will still come after what you owe.

When does child support end in Missouri?

According to state law, child support terminates when a child completes his/her education, or when the child reaches 21.

However, parents or kids can end upkeep payments early via emancipation.

Can you move out at 16 in Missouri?

Missouri child support guidelines allow kids above 16 to petition for emancipation. If successful, emancipation will free the parents from all responsibility towards the child.

Legally, emancipation happens automatically when the child turns 18. But, if the child is enrolled at a high school, college, or university. Payments may continue until 21 or indefinitely if the child is mentally or physically disabled.

Therefore, the eligibility requirements for emancipation in Missouri are:

- The child must be at least 16.

- Parents must consent to emancipation.

- The child’s source of income must be legal.

- Live independently from parents for at least 6 months.

What you must remember is that before awarding emancipation, the judge considers the best interests of the child.

Voluntary termination of parental responsibility

In Missouri, there are three ways to terminate parental responsibility. One is voluntary termination, where a parent gives up his rights and frees up the child for adoption. Two is when a termination petition is mandatory filed. And three is when a termination petition is discretionarily signed.

Remember, termination happens when a parent is found not fit to raise the child, and it is up to the judge to decide what is best for the child.

If you have any additional questions, we recommend that you get a free consultation from a local attorney.

More Missouri Laws