Everything you need to know about Minnesota child support laws, updated for 2020.

Minnesota Child Support Guidelines dictate the court’s actions when dividing parental obligation or awarding alimony.

You might expect the law to be clear, but the truth is the state utilizes complex calculations when awarding child support. That means it is vital that you know how the judge decides what you owe and what you can do to lower your obligation if it causes undue financial harm to you and your new family.

On the other hand, we have parents trying to make ends meet and are heavily reliant on support. The question is, how do I apply for child support? And what do I do if my former partner willfully fails to pay support?

Below is a discussion detailing vital Minnesota child support laws all parents in the state must know!

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

How is child support calculated in Minnesota?

In Minnesota, the default method for collecting child support is automatic wage withholding. So, we must ask, how does the judge determine child support?

To avoid confusion because the calculations are complicated, the Minnesota Department of Human Services established a calculator in 2007.

The calculator does not always yield the right figure because the resulting figure is dependent on your input. Consequently, we must look at what the courts consider when awarding child support.

According to the DHS, to use the state’s calculator, you will need:

- Each parent’s gross income (s).

- Existing child support orders.

- The number of children that live with the parent.

- Any spousal maintenance orders.

- The cost of medical and dental insurance.

- The % or amount of parenting time awarded in a court order.

- Parenting time spent with the child.

- Amount of child care costs.

- The benefits received from social security or the US department of veteran affairs.

With this information, use the calculator to get an estimate.

However, do not forget that the calculator is for educational and informational use only, thus not a substitute for Minnesota child support guidelines. What that means is to the judge, what is important is the best interests of a child. Thus, if the calculator does not produce a fair amount. It is up to the court to look at all factors before awarding financial obligations.

Overall, the judge awards basic child support following the steps below:

- Combine the gross incomes of both parents (from all sources).

- Deduct taxes, employment, retirement plans, or any other relevant deductions as per the guidelines.

- Add parental incomes to determine parental income for child support (PICS).

- Divide PICS based on the proportionate share of the parent’s combined monthly income.

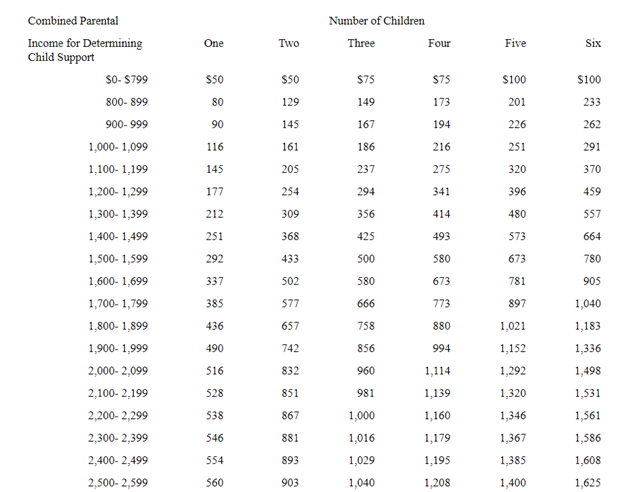

- Refer to the state’s chart of basic obligation.

Below is a snippet of Minnesota’s chart of basic obligation.

Minnesota basic child support obligation chart

How do I file for child support in MN?

The DHS (Department of Human Services) is the body responsible for overseeing Minnesota’s child support system. What that means is, to apply for support or services, download and complete the forms linked.

Then contact DHS via the state website or call this number 800-657-3890.

When you do that, a representative will guide you through the process. Alternatively, visit your county’s Human or Social Services Department.

What to remember:

- If the parents are not married, the parents must establish paternity before the judge issues a child support order.

- Each applicant pays a $25 application fee.

- A district judge, district court referee, and child support magistrate, all have the authority to order child support.

- The deciding party (judge) must follow Minnesota child support guidelines when awarding obligation.

- If the obligor’s and obligee’s parenting time is equal and so are parenting incomes, the court will not order basic support unless if expenses for the child are not equally shared.

How to modify child support in Minnesota

The cost of living adjustment or COLA is a requirement included in Minnesota’s child support guidelines that requires the enforcing body to adjust child support every two years based on changes in the cost of living in the state.

The factors considered here include the cost of food, clothing, housing, and other reasonable child care expenses. If you already have a child support order, it may or may not have this adjustment.

For custodial parents, do not forget, you must request for COLA adjustments every two years.

Grounds for child support modifications

Note that COLA and support modifications are entirely different topics. Modifications in Minnesota refer to changes requested by parents in the state stemming from an unfair child support order.

For example, if the child develops a serious disease, then the law allows either parent to petition for modification. However, there are requirements such as:

- A substantial increase or decrease in either parent’s incomes.

- Extraordinary medical expenses for the child.

- Increase/decrease in work-related child-care costs.

- Modifications that set an unreasonable or unfair amount.

- The child gets emancipated.

In the state, the term “substantial change in circumstances” refers to a situation where, one, the current support order is 20% and $50 lower or higher than the guidelines, the existing order is in percentage form instead of a dollar amount, and when medical provisions are not enforceable.

Consult with a child support attorney to see if your situation qualifies for modification.

To begin the process, refer to ezDocs or call 651-531-5655. Another option is to consult with a family court attorney in your area.

Note, there is a filing fee that the court waives if you are from a low-income family or if you cannot afford to pay it.

What happens if you do not pay child support in Minnesota?

CSED (Child Support Enforcement) is a unit belonging to the DHS that enforces child support guidelines. In its arsenal, the department has a bevy of options that it uses to prompt parents into paying.

On top of that, the department also offers services including…

Location of parents who have disappeared, paternity establishment, modify child support orders, and so on.

Can I go to jail for not paying child support in Minnesota?

In matters of child support, prison, or jail is often the last measure because it hinders your ability to earn. However, that does not mean that the CSED and courts do not have other options.

Before they lock you up, CSED will use the following actions:

- All child support orders in Minnesota include automatic withholding: also, by law, employers must report new hires to the state.

- Report the delinquent party to credit bureaus: this action will affect your mortgage, loans, and credit score. It may also limit your ability to secure employment.

- Garnish bank accounts: with the Financial Institution Data Match, the CSED can track down the delinquent parent’s bank account and collect child support directly.

- If the amount of back child support exceeds $2500, the US State Department automatically restricts, denies, or revokes the debtor’s passport.

- The CSED may charge interests on arrears or place a hold on student grants.

Felony child support nonpayment in Minnesota

In 2011, a Minnesota man whose child support debt accumulated to $83,470 in 11 years faced felony charges. This is not an isolated incident, forcing us to conclude that felony charges depend on the amount of back support you owe.

According to sources, the man from Rochester successfully challenged the charges, and so can you!

That said.

You might face two types of charges here, one, is nonsupport contempt of court charges, or, two, federal criminal prosecution. The penalties for either crime depends on the level of delinquency and other relevant variables.

So, consult with a family court attorney near you.

What is important to remember is that all enforcement actions are preventable by honoring your obligation. Because child support benefits the child and guarantees his/her wellbeing.

Overall, the risk here is jail time, steep fines, income garnishment, or in some cases you might lose visitation or custody rights.

Is there a statute of limitations on child support in Minnesota?

There is no statute of limitations on child support in Minnesota, however, the statute of limitations on judgments is 10 years.

Whereas, if there is no presumed father, the limit is one year after the child reaches the age of majority.

How long do you have to pay child support in Minnesota?

Officially, child support ends on the child’s 18th birthday, but that is not always the case.

That means depending on the stipulations of your child support order and the needs of the child. Child support may continue until the child is 20 or beyond if the child is physically or mentally disabled.

It is also worth mentioning that child support does not terminate if the child leaves the household but does not emancipate.

What is the age of emancipation in Minnesota?

The state of Minnesota/Minnesota child support guidelines, do not have a specified emancipation procedure. Consequently, it is up to the judge to decide whether a child should be emancipated given his/her circumstances.

The factors considered by the court during emancipation hearings are, one, the best interests of the child, two, the minor’s living situation, and, three, parental consent. We advise you to consult with a family court lawyer in your area.

Overall, grounds for emancipation as per Minnesota child support guidelines are:

- Lawful marriage.

- Implied or express parental consent.

- Court order.

Voluntary termination of parental rights

Although the termination of parental rights is not straightforward nor easy, parents in the state can terminate their parental rights and release the child for adoption.

However, it is up to the judge to decide if termination of parental rights is what is best for the child. On top of that, after termination, you will lose your say on how the child is brought up.

On the other hand, involuntary termination requires one of the parents or state to prove that the other caregiver, abandoned, failed to provide financial support, engaged in egregious harm to the child, or is an unfit parent.

Whichever route you choose, it is important to consult with a family court attorney in your area.

If you still have additional questions make sure to get a free case consultation from a local lawyer.

More Minnesota Laws