Everything you need to know about Massachusetts child support laws, updated for 2020.

Massachusetts Child Support Guidelines require parents in the state to provide support and maintenance until a child turns 18.

After divorce or separation, kids from the relationship bind ‘warring’ parents for at least 18 years. Within the 18 years, laws aimed at guaranteeing the best interests of the child dictate the nature of the legal relationship you will have with your former spouse and kids.

That raises the question, what if I lose my job? What if I am paying too much? Or what if your former partner outright refuses to pay?

What can you do?

Continue reading to get the answers plus more!

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

Massachusetts child support guideline revisions 2017

in September 2017,Massachusetts revised its Child Support Guidelines. The vital changes to remember are:

- The presumptive minimum child support shifted from $80.00 per month to $25.00 per week.

- A new calculation for young adults (18-23) came into effect.

- The cost of “reasonably necessary” dental, vision, and health insurance, is shared by the parents in proportion to their income via a two-step calculation.

- The new guidelines introduced extra calculations for caregivers who had parenting time of more than a third but less than half of the total time.

- The maximum contribution made by each party towards the child post-secondary education is capped at 50% of the undergraduate, in-state resident cost of Umass Amherst, “unless the court the court determines that a parent can pay a higher amount.”

How is child support calculated in Massachusetts?

In Massachusetts, the CSE (Child Support Enforcement Division) provides services for both paying and receiving parents. So, to apply for services-call this number (800)332-2733 or click here.

Download all necessary court forms here.

That said.

The version of the ‘Income Shares Model’ the state uses to estimate child support works under the assumption that the child should receive the same amount of support he or she would receive if the parents never separated.

Therefore, the state’s child support formula considers:

- The gross incomes of custodial and non-custodial parents.

- Age of the children.

- General child care costs.

How do I use the Massachusetts child support formula?

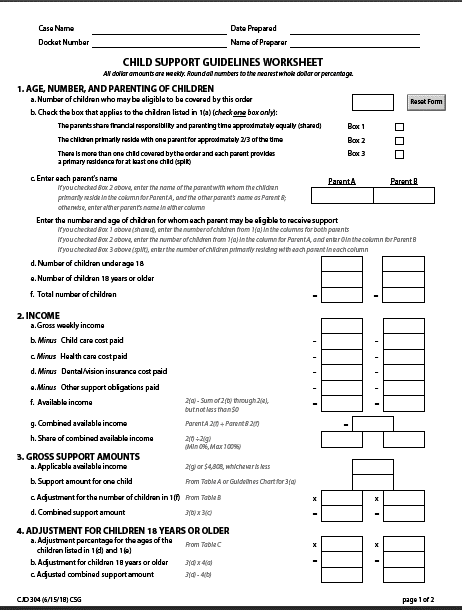

To make estimation easier, Massachusetts provides a worksheet.

See the snippet below.

Page 1, Massachusetts child support guidelines worksheet

Side note: use adobe reader to view the contents of the worksheet.

The law requires the judge to use the linked worksheet in the determination of a child support order. But remember, the amount is dependent on your input, thus, it is important to know the factors that affect your obligation.

The information needed to complete the form include:

- Gross combined weekly income(s) of both parents.

- Child care payments.

- Health care, dental, and vision insurance payments.

- Other support payments.

- The number of children subject to action.

- Child support for children between 18 and 23.

- Contribution to post-secondary educational expenses.

Download worksheet instructions here.

What does ‘income’ refer to in Massachusetts?

State law defines parental income as “gross income from whatever source”. that means salaries, wages, income from self-employment, and so on are subject to garnishment.

Additionally, imputation of income happens when:

One, “the parent has undocumented or unreported income based on evidence submitted“.

Two, “in situations where the parent has unreported income.”

Three, “expense reimbursements, in-kind payments or benefits received by a parent, personal use of business property, and payments of personal expenses by a business in the course of employment, self-employment, or operation of business may be included as income if such payments are significant and reduce personal expenses.”

How to modify child support in Massachusetts

The amount of support the judge settles on is not always fair.

To avoid causing undue stress on the paying parent, Massachusetts child support guidelines allow for modification of child support order. Changes made to the law in 2017, require that before the awarding of the modification request. The petitioning party must prove:

- A substantial change in circumstances.

- The inexistence of previously ordered health care coverage.

- An inconsistency between the amount of the existing order and the amount that would materialize from the application of the guideline.

- Access to previously unavailable care coverage that has become available.

- Previously ordered health coverage that is available but not at a reasonable cost.

Situations that apply for modification include:

- Parent’s or child’s extraordinary expenses for health coverage.

- Extraordinary parenting-related travel costs and expenses.

- Incarceration, unemployment, or job loss.

- An ongoing mental, physical, or developmental issue(parent/kids).

Note that the courts handle modifications on a case by case basis, therefore, consult with a family court attorney in your area.

What about out-of-court agreements?

Although the law allows out-of-court parental agreements, the judge has the final say in the amount you will pay because the law requires the amount to be fair and reasonable.

Therefore, do not sign any legal document outside of court without fully understanding what you are agreeing to.

Remember, the specifics of the case, the amount that would result from the application of the guidelines, and the best interest of the child are a priority for the judge.

What happens if you do not pay child support in Massachusetts?

Under Massachusetts Child Support Guidelines, disobeying child support orders is a punishable offense. Consequently, if your former partner fails to honor his or her obligation. The receiving party notifies the CSE or goes back to court.

Once that happens, enforcement actions listed below will begin:

- The CSE can charge interests and penalties.

- Suspend driver’s, professional, and or recreational licenses.

- Wage or salary withholding.

- Placing a lien on personal property or real estate.

- Private property seizure.

- Credit bureau reporting.

Contempt of court charges in Massachusetts

When facing contempt of court charges, the law requires the accused to defend his position in court. If the excuse for nonpayment is not worthwhile, the judge can use any of the enforcement actions or any action as per the state’s guidelines.

To start contempt charges, download and file the linked forms at your local family court.

There are no charges, but deputy sheriffs charge at most $40 to serve summons and complaints.

Child support arrears forgiveness Massachusetts

The CSE can only lower the amount a parent owes to the state, and not what you owe to the child. Why do I say that?

” Any payment or installment of support under any child support order issued by any court of this commonwealth or by a court or agency of competent jurisdiction of any other state shall be on or after the date it is due, a judgment by operation of law, with the full force, effect, and attributes of a judgment of this commonwealth including the ability to be enforced; shall be entitled as a judgment to full faith and credit; and a judicial or administrative action to enforce said judgment may be commenced at any time; provided that said judgment shall not be subject to retroactive modification except for any period during which there is pending a complaint about modification, but only from the date that notice of such complaint has been given, either directly or through the appropriate agent, to the obligee or, where the obligee is the plaintiff, to the obligor“

What the statute above means is, retroactive child support modification is not legal. Therefore, consult with a family court attorney if you are in severe debt, lost your job, or if you get incarcerated.

What is important to remember is that there is no statute of limitations on child support in Massachusetts, hence, the law can come after the delinquent parent at any time in the future.

At what age do you stop paying child support in Massachusetts?

Although child support officially terminates when the child reaches 18. Massachusetts child support laws may extend payments until the child is 23 if the child is dependent and lives with one of the parents.

Furthermore, if the child is mentally or physically disabled. Child support payments can continue indefinitely.

Do you still pay child support if the child is in college?

Yes, in Massachusetts, the courts can extend child support until the child is 23 if he or she is enrolled full time in a university, college, or post-secondary education facility.

The voluntary and unconditional surrender of parental rights

If the child is up for adoption, the parents must complete “M.G.c.210, 2 (voluntary and unconditional surrender) of parental rights.

This option strips parents of their say on how the child is raised. On top of that, it strips you of all legal responsibility towards the child. but Remember, surrendering your rights is final, meaning, do not make this impulse decision.

Involuntary termination of parental rights happen when:

- A parent is convicted of a violent crime.

- When the court establishes that either parent is unfit.

- If the child is abandoned or subjected to neglect or abuse.

Can I move out at 16 in Massachusetts?

Massachusetts child support guidelines consider you a child until you turn 18. Consequently, there is no formal procedure for emancipation in the state.

However, if your home is an unsafe environment, the judge can terminate parental rights. That will result in:

- Adoption

- Guardianship.

- Permanent placement with a relative.

- Temporary placement in foster care.

If you have additional questions about child support laws in Massachuesetts you can contact a local attorney for a free case consultation.

More Massachusetts Laws