Everything you need to know about Maryland child support laws, updated for 2020.

Maryland child support guidelines continue to work under the presumption that child support is the legal obligation of all parents in the state.

Stemming from this presumption is a formula that, in theory, is supposed to calculate parental responsibility. But how accurate is this formula? And what can you do if you get the “short end of the stick“? legally, that is.

I ask that question because according to state law, said guidelines apply unless one parent can show that the application of these laws is unjust or inappropriate. But before we get to that, we must ask:

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

How is child support calculated in Maryland?

The state of Maryland uses the “Income Shares Model” in the awarding of parental obligation. The formula the state uses relies on a table and worksheet as estimation tools.

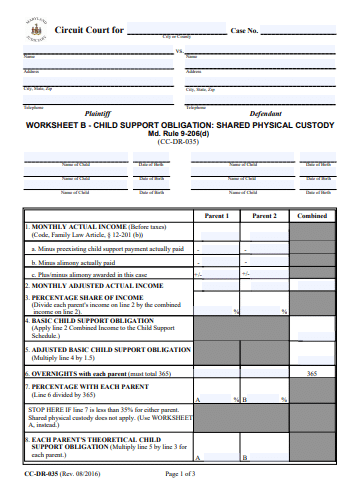

Worksheet A and B child support obligation worksheet. The former (A) is for sole custody cases and the latter (B) for physical custody. See the image below:

Page 1: Maryland child support worksheet.

Download the full worksheet here.

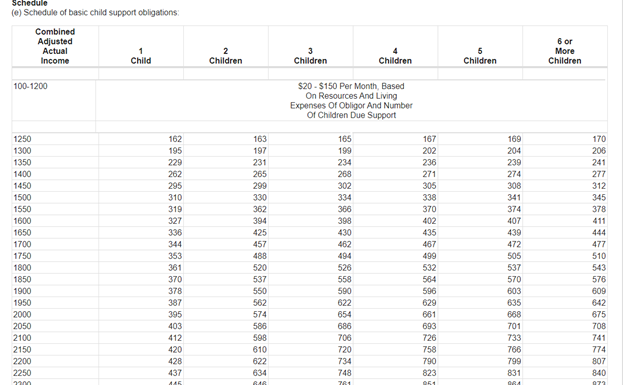

States Schedule of Basic Child Support Obligation. See the image below:

Maryland schedule of basic child support

The idea is, the judge or court combines the incomes of both parents. Then he/she matches that figure to the closest on the state’s schedule of basic child support. Keep reading for more clarity.

Determining Child Support in Maryland

Maryland State law requires that child support be determined following the Basic Child Support Obligation Guidelines. Therefore, the judge when determining child support must consider the following factors:

- Each parent’s “adjusted actual income” and “actual monthly income“: income here refers to salaries, wages, commissions, profits, social security, and so on.

- Work-related child-care expenses such as daycare.

- Extraordinary medical expenses/medical expenses paid out of pocket.

- Health insurance expenses.

However, when calculating actual income, the court will deduct preexisting child support. Thus, if you are already paying support for another child, prepare all the documents that apply (pay stubs, payment history).

Overall, what will happen during determination is:

- The court will calculate the actual incomes of both parents.

- Determine each parent’s “imputed” or actual income.

- Add the actual incomes or imputed incomes.

- Compare the combined amount to the state’s guidelines chart (see snippet above).

- Factor in additional expenses such as daycare, health insurance, to generate total child support obligation.

What is important to remember is that “actual income” means income from any source, whereas imputed income is the amount you would receive if you could work but chooses not to toil.

That means voluntary unemployment or underemployment is not a legal excuse to avoid paying child support in Maryland. That is according to family law 12-201.

Also, if your combined income is higher than $15,000 per month, the judge will decide an amount based on the best interests of the child.

Contact DHS to apply for child support or call this number 800-332-6347.

How to modify child support in Maryland

The amount of support the judge orders is not always fair to the non-custodial parent. But the state allows parents to make changes or modify child support with conditions.

First, parents can request a review or modification every three years. Second, the court allows modifications only if there has been a substantial change in circumstances or a continuing material change in circumstances.

The allowed causes for modification include:

- A significant change in income (incarceration, disease, involuntary job loss).

- Changes in work-related child-care costs.

- Healthcare cost changes.

- Changes in visitation and transportation costs.

- Changes in the financial needs of the child.

Note, the list of grounds for modifications is almost endless, so consult with a family court attorney to see if your situation applies.

To start the modification process, contact the Maryland Child Support Enforcement Administration. But remember, the petitioner has to prove or demonstrate to the court a valid cause for modification.

During the modification process, the parents can avoid legislation if they agree and sign a consent order. This usually takes 30 to 60 days.

Download the full modification guide and form here. Or call 1-800-332-6347.

What if I get incarcerated?

Article 12, Maryland Family Law, allows for arrears to stop accruing for the duration of your incarceration. However, payments will continue once freed.

Additionally. if the incarcerated parent has assets, a business, or on a work-release program, child support collection will continue.

What happens if you do not pay child support in Maryland?

Maryland Child Support Guidelines provide an arsenal of collection actions that a judge or CSEA (Maryland Child Support Enforcement Administration) can use to force delinquent parents into paying.

That means failure to pay child support in Maryland will result in:

- An interception order on the delinquent parent’s state, and or federal tax returns. This also applies to lottery winnings.

- The US State Department will revoke, suspend, or restrict the payor’s passport if back support surpasses $2500.

- CSEA may suspend the payor’s driver’s, professional, and occupational license(s) if child support is outstanding for over 60 days.

- The judge or CSEA-may garnish or levy bank accounts to collect arrears.

- CSEA may report the payor to credit bureaus damaging your credit ratings.

- An automatic wage withholding order may be used to force the payor’s employer to tap child support at the source.

- Unemployment benefits interception.

What is important to remember is, you can prevent all these enforcement actions by honoring your parental obligation. Sure, situations are hard, but non-payment will only add misery to your life. What do I mean?

Willful failure to pay child support may trigger “Contempt of Court” charges.

What you must remember about contempt of court charges in Maryland is imprisonment is applicable only when “the spouse can pay and fails to do so.”

The reason being, incarceration hinders the parent’s ability to pay, thus, incarceration is employed as a final effort.

Consequently, to avoid going to jail or prison, the accused parent must demonstrate to the court his/her inability to pay. That is according to Md. Code, family law 11-110.

Are visitation rights dependent on child support in Maryland?

No, child support and visitation are legally not related to each other, thus, if someone is denying visitation, consult with a family court attorney in your county.

can parents agree to waive child support in Maryland?

No, Maryland child support laws do not allow child support waiver because, quote, “the right to receive child support is a right that belongs to a child.”

Is an attorney necessary?

Legally, for parents in the state, it is not necessary to have an attorney in matters of child support. However, the laws change often, and navigating them on your own can be problematic. So, either work with a lawyer full time or use one as a consultant if you choose to represent yourself.

Is there a statute of limitations on child support enforcement orders in Maryland?

Title 5-102 of Maryland Code Courts and judicial proceedings say that the statute of limitations on child support in the state is 12 years from the date the last payment is due.

When does child support end in Maryland?

Under Maryland child support laws, support automatically terminates when the child is 18 and out of high school. Hence, payments may continue until the child graduates from high school (19). Or continue indefinitely if the child is mentally or physically incapacitated.

What about college or university?

It is fully legal for the parents to agree on how to share expenses beyond 18. The issue depends on your separation or custody arrangement or the outcome of your negotiations.

Voluntary termination of parental rights

Voluntary termination of parental rights usually applies in adoption cases, whereby the parent(s), legally ends his/her legal relationship with the child. What happens after termination is. The child is either placed in foster care or the care of his/her adoptive parents.

Giving up your parental rights means that:

- You will have no say in the child’s upbringing.

- You will have no legal responsibility towards the child.

Also, it is worth noting that the court has the authority to terminate parental rights if it serves the best interest of the child. Thus, if the other party can prove you to be an unfit parent, you may lose your parental rights.

Emancipation in Maryland

State law allows two types of emancipation in Maryland. That is complete emancipation and partial emancipation.

Complete emancipation happens when both parents lose their legal responsibility. Whereas Partial Emancipation is when a parent loses his/her legal responsibility, one, for a specified period, two, for a special purpose. Or, three, as part of a parent’s rights.

That means, to qualify for emancipation, the child must:

- Reach the age of majority (18 years).

- Join the military.

- Get married with parental consent.

- A parent formally or informally agrees to give up parental control.

The court may also approve emancipation if the parent abuses the child or willfully fails to pay child support.

Overall, the judge has the final say in all legal matters. Therefore if you have more questions you should get a free consultation about your specific case from a local lawyer.

More Maryland Laws