Everything you need to know about Maine child support laws, updated for 2020.

Maine child support guidelines require parents in the state to support their minors “to the extent they are able to”.

What does this mean for you, your child, and your former partner? Are there protections or limits on child support in the state?

Let’s find out!

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

How is child support calculated in Maine?

The version of the ‘income shares model’ the state uses in determining child support works under the presumption that. Parents, whether married or not, have a legal responsibility to provide support to their kids. However, the law says “to the extent they are able“.

What that means is. When allocating child support, the judge will consider the incomes of both parents. However, for the sake of fairness, the higher-earning parent often pays more.

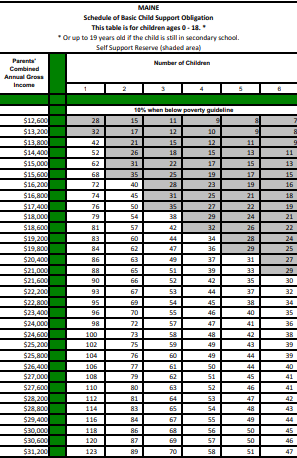

To clarify, during the hearing for determination, the judge or hearing officer will add the incomes of both parents, then compare it to the state’s child support table.

After locating a figure closest to the parents’ combined gross income, the judge will allocate parental obligation.

Chapter 63 child support guidelines, 2006, (1), reads.

“The court or hearing officer shall refer to the table and locate the figure in the left-hand column that is closest to the parents combined gross income. The court or hearing officer shall determine the dollar figure for the total number of children for whom support is being determined and multiply the dollar figure by the number of children. The resulting dollar amount represents the basic support entitlement.”

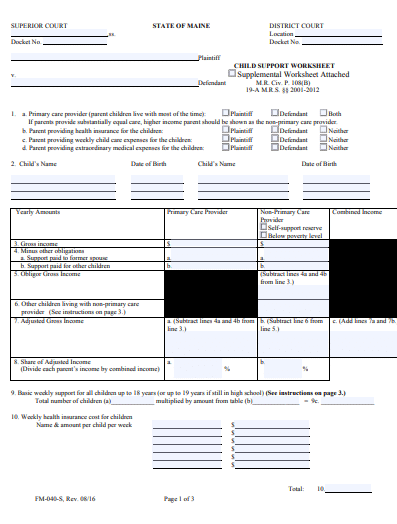

What the statement above means is. To calculate child support, start with the worksheet below:

Page 1: maine child support worksheet

Download the full worksheet and calculation instructions here.

The resulting figure is then compared to Maine’s schedule of basic child obligation.

Because the schedule caps at $400,000, parents whose combined gross income surpasses this, should consult with an attorney.

How is child support established in Maine?

The judge can deviate from the state’s formula if the amount established does not serve the best interests of the child. Thus, in the end, the judge decides the amount as per the state’s guidelines.

Also, state law requires that each parent fill out a Child Support Affidavit (FM-050), that is used to determine parental income. The affidavit, like all legal documents, must be signed in front of a court clerk, attorney, or notary public. After this, each parent hands his/her copy to the other parent.

Remember, the parent whom the children live with or who spends the most time with them is the “Primary Care Giver”, whereas the other is designated “non-primary caregiver”.

Additionally, parents who provide “substantially equal care,” must complete (FM-040-SA) supplemental worksheet.

To “the extent of their ability”

Maine child support guidelines state that the weekly parental obligation for parents whose annual gross is less than the federal poverty level, may not exceed 10% of the non-primary care provider’s weekly income.

Do not forget that the law allows parents to make a child support agreement. But it is up to the judge to decide if the amount is fair and that it serves the best interest of the child.

Maine child support “special circumstances”

As mentioned, the state’s table of basic obligation peaks at $400,000. Consequently, chapter 63 2006 support guidelines, dictates, quote:

“when the parties combined annual gross income exceeds $400,000, the child support table is not applicable, except that the basic weekly support entitlement of a child is presumed to be not less than that outlined in the table for a combined annual gross income of $400,000.”

Factors considered in determining child support in Maine

In general, the factors that determine child support in Maine include:

- Combined incomes of both parents.

- Health insurance cost for the child.

- Daycare costs.

- The subsistence needs of the non-primary caregiver.

- Parental time spent with the child.

- The number of children subject to action.

- Extraordinary medical expenses.

Do not forget, circumstances are different, so talk to a family court attorney in your area.

Legal advice on how to modify child support in Maine

To change or modify a child support order, Maine child support laws require the petitioning party to prove “substantial change in circumstances“.

A Substantial change in circumstances is a vague term, so, to clarify, the term refers to a substantial or permanent change that cannot occur voluntarily. For example, a serious illness that hinders your ability to earn, incarceration, involuntary unemployment, and so on.

There are two ways to modify child support in Maine. Accordingly, the first and the ‘easiest’ is via an agreement between the parents. The second is through a third party, i.e. the court or CSS (Child Support Services).

The CSS provides services including, establishing paternity, locating parents, and determining, collecting, and enforcing child support.

Can child support be modified retroactively in Maine?

According to Maine child support guidelines,

A “child support order may be modified retroactively but only from the date that notice of a petition for modification has been served upon the opposing party, according to the Maine rules of civil procedure.” PL 2009, C290,17.

When pushing for modification, parents in the state must complete the forms linked below:

- Motion to modify.

- FM-002, family matter sheetSocial security number confidential disclosure form (CV-CR-FM-PC-200

- Acknowledgment of service (CV-036)

You may also be required to complete FM-050 (child support Affidavit)

Circumstances eligible for child support modification in Maine

Maine child support guidelines allow modifications if:

- Either parents’ income increases or decreases by 15%.

- Three years after the child support order was issued.

- Involuntary job loss/ unemployment.

What is important to remember is that the petitioner must file a motion for modification and what constitutes a substantial change varies from one case to another. Therefore, consult with an attorney in your area.

What happens if you do not pay child support in Maine?

DSER (Division of Support Enforcement and Recovery), is Maine’s child support enforcing body that often works with the DHHS (Department of Health and Human Services). That means the body works on behalf of both the receiving and paying parents.

However, the law also allows parents to hire private attorneys to help ease caseloads. What is important to remember is, willful failure to pay child support or nonsupport is a punishable offense in the state.

Furthermore, to start enforcement action, the receiving/custodial parent reports non-payment to the department. From there, DSER can use the following enforcement action to strong-arm the delinquent parent into paying:

- Garnish or levy bank accounts: using the information provided by Financial Institution Data Match, the DSER tracks down the delinquent parent’s bank account and either garnishes or instructs your bank to withdraw child support.

- Wage withholding order: this order will require your employer to tap child support directly from your wages, salary, commission, and so on (the order may be automatic).

- Liens against property: if back support is owed for more than 30 days, the state may either withhold wages with no withholding order, or order liens on property.

- License revocation: the payor’s recreational, drivers, and or professional license are subject to revocation or suspension until the parent honors his/her obligation.

Child support Contempt of court charges in Maine

Proving contempt charges in Maine is problematic in that the petitioning party must demonstrate, one, the other parent is intentionally failing to honor his obligation. Two, the party can pay. And three, the delinquent parent is not following the court’s order.

Regardless, these charges must never be taken lightly because conviction may cost you your freedom.

For the custodial parent, you must complete the forms below, following these guidelines:

- CV-CR-FM-PC-200 Social security number confidential disclosure form.

- Rule 66 (FM-068) Motion for contempt.

- (FM-002) family matter summary sheet.

The court may also allow mediation where a court-appointed person listens to both accounts and helps the parents reach an agreement.

Is there a statute of limitations on arrears in Maine?

There is no statute of limitations on back child support in Maine. Also, state law requires paternity to be established before the child turns 18.

Furthermore, debt forgiveness is a rare occurrence in Maine. So, consult with a lawyer if you are in deep debt.

At what age does child support end in Maine?

Child support terminates in Maine when the child turns 18, however special circumstances such as a 19-year-old who is still in high school may prompt the judge to extend payments.

Additionally, child support may continue indefinitely if the child is mentally or physically disabled.

Termination of parental rights

Maine child support guidelines give the judge authority to terminate parental rights if the parents voluntarily and knowingly consent. The conditions for termination are:

- Termination must be in the best interest of the child.

- Or if the court finds that “the parent is unwilling and unable to protect the child” or “the parent has been unwilling or unable to take responsibility” or the parent has abandoned the child.

In other words, the court must find you unfit to be a parent.

How do I get emancipated in Maine?

Maine child support laws require the petitioning party (minor) to be:

- At least 16 years old.

- The minor must be financially independent.

- Demonstrate to the court that emancipation is in your best interest.

Consult with a family court attorney near you to find out if you qualify for emancipation.

If you have additional questions, don’t hesitate to reach out to a local attorney in your area for a free case consultation.

More Maine Laws