Everything you need to know about Louisiana child support laws, updated for 2020.

Under Louisiana child support guidelines, both parents are responsible for the financial support of the child(ren).

However, if we delve into specifics, you will notice that often, one parent provides more financial support than the other. The question is, how does the system decide how much you will pay? And what rights and protections are available to non-custodial and custodial parents in the state?

We will also tell you how to lower your obligation and how to terminate child support early in Louisiana, but first:

Under Louisiana child support guidelines, both parents are responsible for the financial support of the child(ren).

However, if we delve into specifics, you will notice that often, one parent provides more financial support than the other. The question is, how does the system decide how much you will pay? And what rights and protections are available to non-custodial and custodial parents in the state?

If after reading this you have further questions and would like a consultation, you can get a free case consultation from a local lawyer here.

We will also tell you how to lower your obligation and how to terminate child support early in Louisiana, but first:

How is child support calculated in Louisiana?

Starting with the basics. The state of Louisiana adopted the “income share” method to estimate child support. This method works under the assumption that both parents have a legal obligation to provide care and financial support to their kids.

However, the state applies the formula when it serves the best interests of the child, meaning the judge or the State’s Child Support Enforcing body can deviate from it in more complex cases.

To begin with, the courts consider gross income, hence, any income you receive including, wages, bonuses, dividends, pensions, annuities, capital gains, and so on. Are subject to collection by the Department of Children and family services.

Second, parents in the state who do not receive Medicaid, FITAP, or KCSP pay a non-refundable $25 application fee.

Question: How is child support determined in Louisiana?

Louisiana employs a formula to aid the estimation of child support. Thus, the judge may use it in sole custody cases, and in joint custody.

R.S 9:315.19 contains Louisiana’s schedule of basic child support obligation table. The judge uses the table as a reference when awarding child support, the idea is, combine the gross incomes of the parents, then compare to the chart.

The table goes up to $40,000.

For parents earning more than this figure, the law states that child support will be determined on a case by case basis.

How do I use the table?

The table works in tandem with the state’s worksheet.

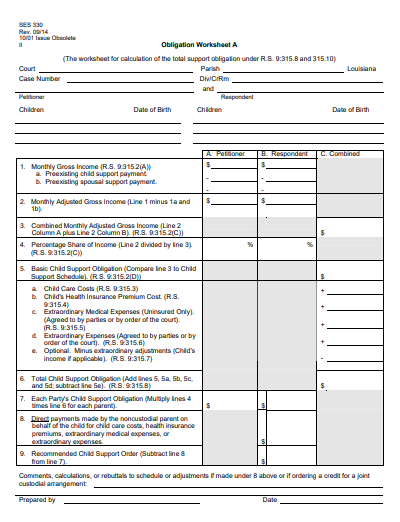

Using the states worksheet makes calculations easier in that it tells you the factors that affect the final amount. See the snippet below.

Louisina child support worksheet A: http://dcfs.la.gov/assets/docs/searchable/ChildSupportServices/SES%20330%20Obligation%20Worksheet%20A.pdf

What is important to remember is that the amount you get is dependent on your input. Thus, your estimate will not always be right. Why?

When deciding support allocation, the judge will look at the best interest of the child. Accordingly, the state’s guidelines consider general costs related to child care and child care costs as two different payments.

What does this mean?

When awarding child support, the judge will consider, one, the incomes of both parents, alimony paid, childcare costs, general childcare costs, the kind of custody (shared or single), and the number of children in the relationship.

Additionally, parenting time is not a standard claim on deviating from child support guidelines in Louisiana.

How do I modify child support in Louisiana?

Louisiana child support guidelines provide two ways to push for modification. Thus, you can either lawyer up or push for modification yourself.

If you choose the latter route, here is what you must do:

- Fill out and file the Rule to Modify Child Support Form.

- File your papers with the clerk of court’s office.

- Explain to the judge why your child support order should be changed.

On top of that, for the department of child services to process your request, you must provide the following information:

- Child care costs.

- Income with written proof of current earnings and most recent federal income tax return.

- Health insurance.

- Out of pocket medical expenses.

To ask for a review, please contact 1-888-524-3578 or use this self-service portal.

If you opt to hire a lawyer, he or she will guide you through the process.

That said.

The judge cannot legally award child support modification for simply asking. That means the party pushing for modification must provide evidence of a “material change in the circumstances.”

The reason for that is La. REV. Stat.9:311 (E), reads in part, quote,

“if the court does not find good cause, sufficient to justify an order to modify child support or the motion is dismissed before a hearing. It may order the mover to pay all costs and reasonable attorney fees of the other party if the court determines the motion was frivolous.”

‘Frivolous’ means, “not having any serious purpose or value.”

This tells you pushing for modification without just cause in Louisiana may be expensive. Accordingly, how do I guarantee successful modification?

The petitioning party must prove to the judge any of the following:

- Disability.

- A substantial shift in income (increase/decrease).

- Imprisonment.

- Bankruptcy.

- Serious health condition.

Remember, each case is unique, so talk to a family court attorney in your county to find out if you are eligible for modification.

What kind of legal trouble can you get if you fail to pay child support in Louisiana?

The remedies for non-support are contained in title 14, criminal law, RS14:75 Failure to Pay Child Support Obligation. The law commonly referred to as “Deadbeat Parents Punishment Act of Louisiana”, grants the courts and child protection services the authority to:

- Fine a delinquent parent, not more than $500, imprisonment for not more than 6 months, or both for a first offense.

- For a second offense or subsequent non-support offense, the penalty is a fine of not more than $2500, imprisonment with hard labor, a fine, or both.

- If the amount of back support exceeds $15000 or if child support is left unpaid for at least one year. The fine is not more than $2500, imprisonment with/without hard labor, or both.

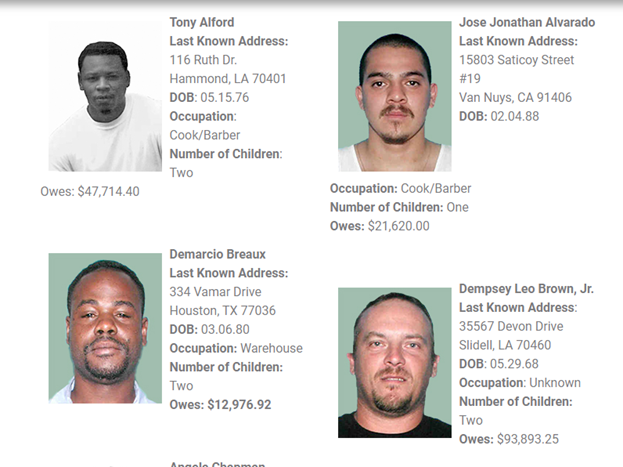

Most wanted delinquent payors

Six months’ worth of back child support, or if you owe at least $10,000 earns you a spot on the state’s “most wanted” page.

Notice how the address, occupation, and last known whereabouts are put on full display. This is a shaming tactic aimed at forcing parents to pay and the law provides an avenue to keep it from happening to you and ruining your privacy.

How?

RS14:75 (4) reads “in any case in which restitution is made before the time of sentencing. except for a second or subsequent offense. The court MAY suspend all or any portion of the imposition or execution of the sentence otherwise required in the subsection”

That means enforcement action is preventable by simply honoring your obligation.

The court may also use the following remedies:

- Suspend the delinquent parent’s vehicle registration.

- Intercept the delinquent parents’ wages, salary, or income.

- Suspend the payor’s driver’s, recreational, or professional license.

Initiate contempt proceedings

In Louisiana, when contempt proceedings begin, the delinquent parent is required to go to court and explain his/her failure. Contempt charges should not be taken lightly, because if proven. The consequence may be prison time with or without hard labor.

Therefore, if you lose your job, get incarcerated or for any reason fail to honor your obligation. Contact DCFS or your county’s clerk office.

Does child support automatically stop at 18 in Louisiana?

In Louisiana, child support does not automatically terminate when the child turns 18. Instead, R.S.9:315.22, require that if a child is dependent on either parent, is still in high school or unmarried. Payments will continue until his/her 19th birthday. Accordingly, if the child has a developmental disability, the judge may order payments until 22 or indefinitely if the child is mentally or physically incapacitated.

To clarify, when the child reaches the “age of majority”, the payor must notify the receiving parent or enforcing body to end payment.

However, if all factors remain constant. Payments will end when the child turns 18.

Termination of parental rights in Louisiana

Louisiana child support guidelines allow parents to voluntarily relinquish their parental obligation. But, the standards are strict and the parent petitioning stands to lose his or her say on how the child is raised.

On top of that, if your parental rights are terminated, you will no longer have any financial obligation to the child. Remember, to terminate your parental rights, the court must find clear and convincing evidence that you are an unfit parent.

That said.

Termination of parental rights usually applies when the child is up for adoption. Involuntary termination, on the other hand, may occur if the court finds that:

- The parent is addicted to drugs.

- A parent has committed a serious felony that resulted in bodily injury or death, including, murder, sodomy, starvation, incest, and so on.

Emancipation in Louisiana

Minors residing in troubled households have the option to free themselves from their parents via emancipation. Although emancipation gives legal rights of adulthood to minors, it does not affect other laws such as the state’s drinking age.

Louisiana child support laws provide three ways to get emancipated, one, is through marriage, two, via court hearing, and, three, by an ‘authentic act’.

Whatever route you choose, what you must remember is:

- You must be at least 16 years or older.

- Financially independent.

- Your income must be legal.

If you have additional questions, don’t hesitate to get a free consultation from an attorney in your area.

More Louisiana Laws