Everything you need to know about Child Support Laws in Georgia. Updated 2021.

In 2018, modifications were made to Georgia child support guidelines with the hope that the new laws would improve the perception of fairness. In the past, the state of Georgia calculated child support based solely on the income of the non-custodial parent, however, after the changes were made. Georgia adopted the ‘Income share model’, whereby the incomes of both parents are now considered. That raises the question.

- How is child support calculated in 2021 Georgia?

- How does the number of kids and remarriage affect child support in Georgia?

- What does "deviation" in Georgia child support mean?

- How can I get my child support arrears dismissed in Georgia?

- How do you enforce child support in Georgia?

- What happens if you don't pay child support in Georgia?

How is child support calculated in 2021 Georgia?

O.C.G.A 19-6-15 (section of Georgia child support guidelines) was revised in 2007, bringing in new guidelines structured around the income shares model. Before this, Georgia used the percentage of income model. The issue with the latter model is that it laid more burden on the non-custodial parent, this was perceived as unfair.

Nowadays, or after the new modifications. Family courts in Georgia take into account the:

- Incomes of both parents

- The number of kids that need support.

- The amount of time each parent spends with their kids.

Apply for child support online here.

Incomes of both parents

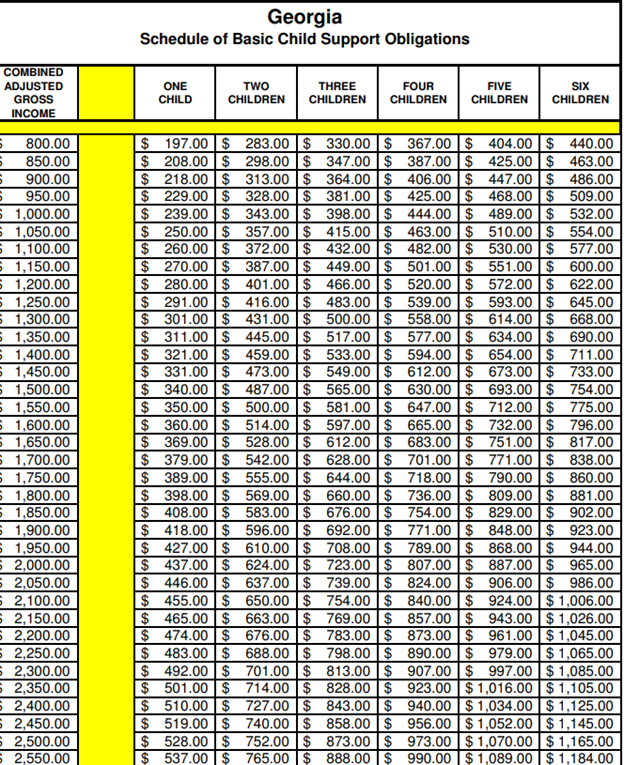

Under Georgia child support laws, calculating the basic obligation of parents requires that you add your adjusted gross income, and then match the figure with the column containing the number of children.

You can utilize the Judicial Council of Georgia’s Child Support Calculator here.

Nonetheless, before a number is decided, the court will consider the following sources of income:

- Salary, wages, and overtime.

- Commissions and bonuses.

- Income from self-employment.

- Rental property income.

- Severance pay or pension income.

- Capital gains.

- Unemployment benefits.

The vital factor to remember at this stage is that the percentage of your contribution to the gross combined income will determine your parental obligation. Consequently, the higher-earning parent will often pay more.

Also, half of the self-employment taxes, expenses related to kids from previous relationships, and existing child support payments are deducted.

How does the number of kids and remarriage affect child support in Georgia?

Note that remarriage does not directly affect child support, however, if you remarry and your new partner earns more than you, his or her income may be considered. On top of that, if your new partner makes enough to cover all household expenses. The court may assume that you have more disposable income, thus, you may be ordered to pay more.

Remember that the court will only consider a new spouse’s income under “unusual circumstances” such as when you no longer have to work. So, getting your former husband’s new wife to pay child support is not as easy as it sounds on paper. Therefore, talk to a local family court attorney.

If a new child comes into the picture or if there is a substantial change to your income, you may be a candidate for modification. But remember, all this is at the judge’s discretion, so gather enough evidence including, household expenses, unusually high cost of travel for visitation and such, before you push for modification.

Some welcome relief for the non-custodial parent is. There is a two-year limit that restricts your former partner from making more than 1 modification every two years. But, and that’s a big one. If parenting time changes or if you suffer significant income reduction through no fault of your own, you are allowed to petition the court for a modification.

In a general sense, grounds for modification in Georgia include:

- A substantial change in financial circumstances.

- Perceived unfairness such as overpaying.

- If the non-custodial parent has failed to exercise court-ordered visitation.

To prove your case, you may also need your former partner’s current income information. So, consult with a lawyer.

All in all, Georgia courts provide a calculator that you can use here.

What does “deviation” in Georgia child support mean?

A deviation is any agreement between the parents or judgment passed that goes against the formula dictated by the child support formula. For example, a judge may decide that the statutory amount is not in the best interest of the child, thus he or she may decide a more suitable figure. In Georgia, deviations may include, but not limited to:

- Unusual travel expenses

- Alimony

- Mortgage.

- Parenting time

- Life insurance.

- Low/high income.

- Other health-related insurance.

It is worth noting that the judicial council of Georgia is surveying parenting time deviation, we will update you on what that means for the future.

How can I get my child support arrears dismissed in Georgia?

You cannot drop child support arrears in Georgia, that is according to state law. Furthermore, the debt will continue to pile long after the child has grown into adulthood. Remember, child support orders in Georgia accrue interest at 7% per year and failure to pay for 30 days is considered delinquent.

When it comes to enforcement. O.C.G.A 9-12-60 (d), says there is no statute of limitations on enforcement, meaning, back child support may shadow you into old age. Accordingly, this law applies even if you file for bankruptcy.

The point is, the only way out of child support arrears is a repayment plan or an agreement made with your former partner. Accordingly, if you lose your job, or if your income changes. It is in your best interest to contact DCSS or your former partner.

This raises the question:

How do you enforce child support in Georgia?

There are four ways to enforce child support in Georgia:

- File a contempt of court action.

Contempt of court order carries the threat of possible jail time; it is a serious offense or violation of the law. The idea is to present to the court evidence that your spouse is willingly skipping child support. That will prompt the judge to issue sanctions including jail time.

Additionally, if you go to jail for failing to pay child support, your obligation doesn’t cease, and the amount will continue to pile as long as you ignore them. That is why jail time is often the last resort.

- Income deduction order

To avoid sticky situations, an income deduction order will require your partner’s employer to garnish child support directly from your former partner’s paycheck. This will guarantee timely payments and less direct conflicts.

- A write of Fieri Facias (Fi. Fa)

This can be issued if the delinquent parent owns any property. It is thus a lien on real estate owned by the non-custodial parent.

- File a garnishment

The custodial parent can acquire a garnishment order if the non-custodial parent is 30 days behind on his or her payments. This will trigger direct deductions from social security benefits, paychecks, and all sources of income.

All in all, enforcement starts when you contact the Georgia Department of Human resources. Which is the enforcement body for the Division of Child support Services (DCSS). Alternatively, you can take the matter to court depending on your circumstances.

What happens if you don’t pay child support in Georgia?

Code section 15-11-96 of Georgia child support guidelines read, quote:

“the court by order may terminate the parental rights of a parent concerning the parents’ child if: (1) a decree has been entered by a court of competent jurisdiction of this or any other state ordering the parent, guardian, or other custodians to support the child, and the parent, guardian, or other custodian has wantonly and willfully failed to comply with the order for 12 months or longer.”

That means you stand to lose your child. Furthermore, your parental rights may be terminated if:

- The court finds misconduct or inability to pay.

- The parent is found guilty of murdering the child’s other parent.

- Parent consents in writing to the termination.

- The child is abandoned.

If losing your child is not harsh enough, the DCSS and court are allowed to use the following punitive measures to collect child support:

- Professional, business, recreational, or driver’s license suspension or denial.

- Wage garnishment.

- Liens on property.

Remember, if your parental rights are terminated in Georgia, you will no longer be entitled to notice any further proceedings regarding the child.

How do I stop child support payments in Georgia?

Under Georgia child support laws, payments cease when the child reaches 18 and is out of high school. However, if the child is 20 but still in high school, you no longer have to pay. Also, child support ends if the child dies or is legally emancipated.

To be eligible for emancipation in Georgia:

- A minor must be legally married.

- Join the military.

The idea is to demonstrate to the court that emancipation is in your best interest and that you are capable of taking care of yourself. To that end, you can ask for sworn statements in your favor from professionals such as an attorney, law enforcement officer, clergy member, school principal, guidance counselor or social worker, therapist, or any adult that fits this criterion.

Unlike other states, Georgia allows emancipated minors to ask the court for reversal if you have resumed a family relationship with your parents, guardians or parents agree to rescind the order, or if you have no means of supporting yourself.

All in all, whether you are giving or receiving child support. Contact DCSS for specific information about your case. Additionally, all agreements made out of court must be done in writing. So, consult with a family court attorney in your area today. And if you have any questions, use the comment section!

New Georgia Child Support Laws 2020

Georgia Child Support Laws were most recently updated in 2018 to the income shares model.

If you have additional questions about family law, get a free consultation today.

More Georgia Laws