📑 Table of Contents (click to expand)

- Quick Summary: Colorado Child Support

- How is Child Support Calculated in Colorado?

- Colorado Child Support Guidelines for Income Levels

- What Does Child Support Cover?

- Enforcement and Penalties

- When Non-Payment Becomes a Felony

- Child Support and Unemployment

- When Does Child Support End?

- Frequently Asked Questions

- Additional Resources

Last verified: February 2026. Colorado child support guidelines are governed by C.R.S. § 14-10-115. Colorado uses the Income Shares Model, which bases support on what the family would have theoretically spent on the child if the parents had not separated. The guidelines are periodically updated, with legislative changes in 2025 amending certain provisions.

Quick Summary: Colorado Child Support at a Glance

- Calculation Method: Income Shares Model

- Governing Statute: C.R.S. § 14-10-115

- Basic Support Percentage: Approximately 20% of combined gross income for one child, plus 10% for each additional child

- Income Cap: $30,000 per month combined gross income

- Minimum Support (income under $1,100/month): $50 for 1 child, $70 for 2, $90 for 3

- Age of Termination: 19 years old (or until high school graduation, up to age 21)

- Enforcement Agency: Child Support Services (CSS), Colorado Department of Human Services

How is Child Support Calculated in Colorado?

Colorado uses the Income Shares Model to calculate child support under C.R.S. § 14-10-115. This model is based on the principle that children should receive the same proportion of parental income that they would have received if the family had remained intact.

Child support is owed to the child, not to the other parent. This distinction matters because it emphasizes that support is about meeting the child’s needs, not compensating the custodial parent.

The calculation considers:

- Both parents’ gross incomes from all sources

- Parenting time (how many overnights each parent has)

- Childcare costs (such as daycare)

- Health insurance costs for the child

- Extraordinary expenses (special needs, education)

What counts as gross income:

- Wages, salaries, tips

- Commissions and bonuses

- Self-employment income

- Overtime pay

- Pensions and retirement benefits

- Social Security benefits

- Unemployment benefits

- Workers’ compensation

- Interest and dividends

- Rental income

- Trust income

- Annuities

- Alimony received

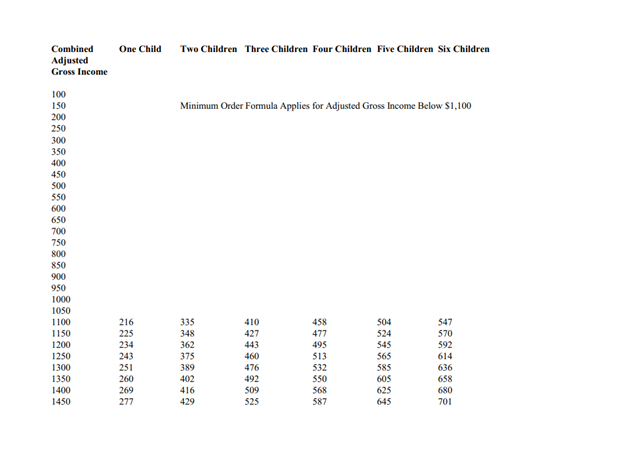

Colorado Child Support Guidelines for Income Levels

The Schedule of Basic Child Support Obligations provides presumptive support amounts based on combined adjusted gross income. The schedule covers incomes from $0 to $30,000 per month.

Low-Income Parents

Under C.R.S. § 14-10-115, if your monthly income is below $1,100, you are subject to minimum support amounts:

- 1 child: $50 per month

- 2 children: $70 per month

- 3 children: $90 per month

These minimums can apply to either or both parents depending on their income levels.

High-Income Parents

Under C.R.S. § 14-10-115(7)(a)(II)(E), when combined adjusted gross income exceeds $30,000 per month:

“The court may use discretion to determine child support in circumstances where combined adjusted gross income exceeds the uppermost levels of the schedule of basic support obligations; except that the presumptive basic child support obligation shall not be less than it would be based on the highest level of adjusted gross income in the schedule.”

In practice, this means the court can order higher support based on the child’s reasonable needs and the family’s standard of living. The minimum support for high-income parents is what would be calculated at the $30,000 combined income level.

What Does Child Support Cover in Colorado?

According to Child Support Services (CSS), child support is intended to cover the child’s share of:

- Housing and shelter

- Food and clothing

- Education expenses

- Medical and dental care

- Transportation

- Entertainment and extracurricular activities

The CSS determination considers:

- Financial resources and needs of the non-custodial parent

- The standard of living the child would have enjoyed if the family remained intact

- Physical, emotional, and educational needs of the child

- Financial resources of the custodial parent

- Financial resources of the child (such as trusts or inheritances)

Enforcement and Penalties for Non-Payment

Failure to pay child support in Colorado can result in two tracks of enforcement: administrative actions by CSS or court proceedings that may result in contempt charges.

Administrative enforcement by CSS:

- Income withholding: Automatic deductions from wages, unemployment, retirement, and workers’ compensation

- Tax refund interception: State and federal tax refunds can be seized

- Lottery and gambling interception: Winnings can be seized

- Credit bureau reporting: Delinquencies are reported to credit agencies

- License suspension: Driver’s, professional, and recreational licenses may be suspended

- Bank account levies: Funds can be seized directly from bank accounts

- Property liens: Liens can be placed on vehicles, real estate, and other property

- Property seizure: Property may be sold to satisfy arrears

Court enforcement:

If CSS administrative actions are insufficient, the case may be referred to court. If a parent is found in contempt of court for failing to pay support, the consequences may include:

- Fines

- Payment of the other parent’s attorney fees

- Jail time

- A bench warrant for arrest

If a bench warrant is issued, you are subject to arrest at any time, including during a routine traffic stop. If you have an outstanding warrant, contact an attorney immediately to address it.

When Non-Payment Becomes a Felony

Child support non-payment can be charged as a misdemeanor or felony depending on the amount owed and how long payments have been missed. If you intentionally leave the state to avoid paying child support, you may face federal charges.

The specific criminal charge depends on:

- Total amount of unpaid support

- Length of time since the last payment

- Whether you left the state to avoid payment

- Whether there is evidence of willful non-payment versus inability to pay

Child Support and Unemployment in Colorado

Colorado law distinguishes between voluntary and involuntary unemployment when calculating child support.

Involuntary Unemployment

If you lose your job through no fault of your own, become disabled, or are caring for a young child (under 30 months) for whom both parents share responsibility, your actual income will typically be used in the calculation. Courts will not impute additional income if you are genuinely unable to work.

The same protection applies to incarcerated parents who cannot earn income.

Voluntary Unemployment or Underemployment

If the court finds that you are intentionally avoiding employment or working below your capacity to reduce support obligations, it may impute income. This means calculating support based on what you could be earning rather than what you actually earn.

Examples of voluntary underemployment include:

- Quitting a job without good cause

- Reducing work hours without justification

- Leaving a professional career to work hourly labor

- Failing to make reasonable efforts to find employment

Under C.R.S. § 14-10-115(b)(I), if imputed income is used, it is based on “potential income” considering your work history, qualifications, and job market conditions.

You can challenge an imputed income determination by providing evidence that you are actively seeking appropriate employment.

When Does Child Support End in Colorado?

The age of emancipation in Colorado is 19. However, child support does not necessarily end on the child’s 19th birthday.

Support continues beyond 19 if:

- The child is still in high school: Support continues until the end of the month of graduation or until the child turns 21, whichever comes first

- The child has a physical or mental disability: Support may continue indefinitely if the child cannot support themselves

Support may end before 19 if:

- The child joins the military

- The child gets married

- The child moves out and becomes financially self-sufficient

- The child is legally emancipated

- The child dies

Important: Child support payments do not automatically stop. You must file a motion with the court and notify all relevant parties (CSS, employer if wages are being garnished, custodial parent) to terminate the order. If you overpay, an attorney may be able to help you recover excess amounts.

Colorado does not require parents to pay for college expenses unless they voluntarily agreed to do so in their divorce agreement.

Frequently Asked Questions

What happens if I lose my job?

Contact CSS immediately to report your change in circumstances. If your unemployment is involuntary, you may be able to get a modification. Do not simply stop paying, as arrears will continue to accumulate. File for modification as soon as possible to protect yourself from mounting debt.

Can child support be modified in Colorado?

Yes. Either parent can request a modification if there has been a substantial and continuing change in circumstances, such as job loss, significant income change, or change in custody arrangements. The modification takes effect from the date of filing, not retroactively.

What if I can’t find work?

If you are making good-faith efforts to find employment and can document your job search, the court should use your actual income rather than imputed income. Keep records of all job applications, interviews, and rejections.

Can I go to jail for not paying child support?

Yes. Willful failure to pay child support can result in contempt of court charges, which may include jail time. If a bench warrant is issued, you can be arrested at any time.

Does child support cover college?

Not automatically. Once the child reaches 19 and has graduated high school, there is no legal obligation to pay child support or college expenses in Colorado unless the parents agreed to college support in their divorce agreement.

Additional Resources

Colorado Child Support Services (CSS)

- Website: childsupport.state.co.us

- Apply for services: CSS Application

Official Documents:

- C.R.S. § 14-10-115: Colorado Child Support Guidelines (Justia)

- Colorado Child Support Guidelines Worksheet (JDF 1822)

- Colorado Family Law Guide: Child Support

For personalized legal advice about your Colorado child support case, consult with a family law attorney.

More Colorado Laws