📑 Table of Contents (click to expand)

- Quick Summary: Arizona Child Support

- How is Child Support Calculated in Arizona?

- Understanding Arizona’s Income Shares Model

- How to Modify Child Support

- Arizona Child Support Enforcement

- When Non-Payment Becomes a Felony

- Retroactive Child Support in Arizona

- When Does Child Support End?

- Frequently Asked Questions

- Additional Resources

Last verified: February 2026. Arizona child support guidelines are governed by ARS § 25-320 and the Arizona Child Support Guidelines adopted by the Arizona Supreme Court. The current guidelines became effective January 1, 2022 (revised September 21, 2022), with the next quadrennial review having begun in January 2024.

Quick Summary: Arizona Child Support at a Glance

- Calculation Method: Income Shares Model

- Governing Law: ARS § 25-320 and Arizona Child Support Guidelines

- Current Guidelines: Effective January 1, 2022 (revised September 21, 2022)

- Age of Termination: 18 years old (or high school graduation if still enrolled at 18)

- Enforcement Agency: Division of Child Support Services (DCSS) within the Department of Economic Security (DES)

- Key Statute: Arizona Revised Statutes § 25-320

How is Child Support Calculated in Arizona?

Arizona uses the Income Shares Model, developed by the Child Support Guidelines Project of the National Center for State Courts. This model estimates the amount parents would have spent on their children if the family remained together, then divides that amount between the parents proportionally based on their incomes.

The Arizona Supreme Court adopts child support guidelines through Administrative Orders, and state law requires a review of these guidelines every four years.

Key factors in calculating child support include:

- Both parents’ gross incomes from all sources

- The number of children

- Parenting time (number of days each parent has with the child)

- Cost of health insurance for the children

- Childcare costs (such as daycare)

- Extraordinary expenses (special needs, education)

Arizona provides an official Child Support Calculator to help parents estimate their obligations.

Understanding Arizona’s Income Shares Model

Under the Arizona Child Support Guidelines, “gross income” includes income from any source, including:

- Wages, salaries, and commissions

- Self-employment income

- Bonuses and overtime

- Severance pay

- Pensions and retirement benefits

- Social Security benefits

- Unemployment and workers’ compensation benefits

- Spousal maintenance (alimony) received

- Interest, dividends, and rental income

- Trust income

Certain deductions are allowed from gross income to arrive at “adjusted gross income,” including spousal maintenance paid to a former spouse and support for other children.

How the calculation works:

- Determine each parent’s adjusted gross income

- Combine both incomes to find total family income

- Look up the Basic Child Support Obligation on the Schedule based on combined income and number of children

- Divide the obligation between parents based on each parent’s percentage of combined income

- Add each parent’s share of health insurance and childcare costs

- Adjust for parenting time if applicable

Under ARS 23-722.01(d), Arizona employers must report new hires within 20 days. DES uses this information to locate parents for child support enforcement.

How to Modify Child Support in Arizona

Arizona law requires “a substantial and continuing change in circumstances” to modify an existing child support order. Remarriage alone is generally not sufficient grounds for modification.

Valid grounds for modification include:

- Job loss (involuntary unemployment)

- Disability

- Significant increase or decrease in either parent’s income

- Changes to health insurance costs or availability

- Change in parenting time arrangements

- Change in the children’s needs

To request a modification, complete and submit Form CSE-1178A to the Division of Child Support Services.

Important: Child support modifications in Arizona cannot be made retroactively. A modification only affects future payments from the date the modification request is filed.

Arizona Child Support Enforcement

Arizona takes child support enforcement seriously. The Division of Child Support Services (DCSS) uses multiple enforcement tools to collect unpaid support.

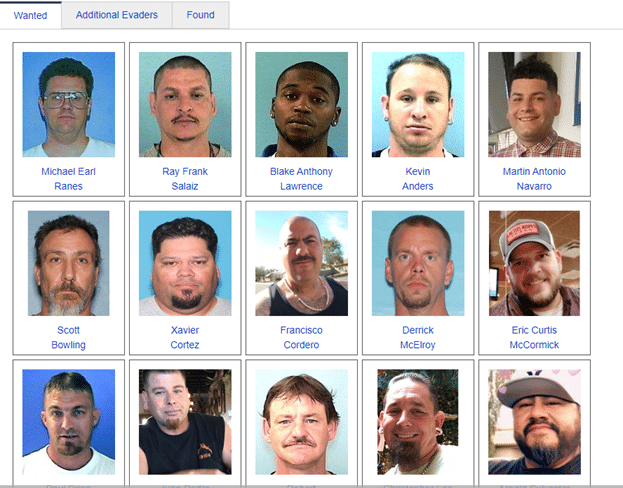

Arizona notably uses public shaming as an enforcement tactic. The DES website maintains a “Most Wanted” list of parents who owe more than $5,000, whose location is unknown, who have arrears of at least 12 months, or who have not made payments in the last six months.

Enforcement actions include:

- Income withholding: Automatic deduction from wages, unemployment, retirement, and other income sources

- Credit bureau reporting: Delinquencies are reported to credit agencies, affecting your ability to obtain loans or mortgages

- Tax refund interception: State and federal tax refunds can be seized

- Lottery interception: Any winnings above $600 are subject to seizure

- Bank account levies: Funds can be seized from bank accounts if arrears exceed 12 months

- Property liens: Liens can be placed on vehicles, homes, and other property

- License suspension: Driver’s, professional, recreational, and sporting licenses may be suspended for six months or more

- Passport denial: Passports may be denied or revoked

When Non-Payment Becomes a Felony in Arizona

“Failure of a parent to provide for a child” is a criminal offense in Arizona. The severity depends on the circumstances:

- Misdemeanor: Can result in fines up to $2,500 and up to six months in jail

- Class VI Felony: Willful failure to pay can result in up to 1.5 years in prison

The typical process is: a parent fails to pay, the custodial parent reports the delinquency, and the non-paying parent is charged with “contempt of court.” If found in contempt, the court may impose fines, jail time, or both.

If you know you will be unable to make payments, contact the custodial parent to reach an agreement, or contact the court immediately to explain your situation. Proactive communication is always better than waiting for enforcement actions.

Retroactive Child Support in Arizona

Arizona does allow retroactive (back) child support under certain circumstances. According to ARS § 25-320:

“If child support has not been ordered by a child support order and if the court deems child support appropriate, the court shall direct, using a retroactive application of the child support guidelines to the date of filing a dissolution of marriage, legal separation, maintenance or child support proceeding, the amount that the parents shall pay for the past support of the child.”

Key points about retroactive support:

- Retroactive support only applies when there is no existing child support order

- The retroactive period cannot exceed three years before the divorce or support filing date

- Retroactive support is not automatic; the custodial parent must specifically request it

- The court must determine the amount is appropriate based on the circumstances

For non-custodial parents: while retroactive support can be ordered, modifications to existing orders cannot be applied retroactively. If your circumstances change, file for modification as soon as possible to limit future obligations.

When Does Child Support End in Arizona?

Child support in Arizona typically ends when the child turns 18. However, there are exceptions:

Support continues past 18 if:

- The child is still in high school (support continues until graduation or age 19, whichever comes first)

- The child has a physical or mental disability that prevents self-support (may be indefinite)

Support may end before 18 if:

- The child gets married

- The child joins the military

- The child becomes legally emancipated (available at age 16 or older)

- The child dies

Requirements for emancipation (age 16+):

- Financially self-sufficient

- Proof of living independently for at least 6 months

- Demonstration that the home environment is unsafe, or notarized parental consent

Important: Child support does not stop automatically. Your support order has a termination date, but you must file a petition to stop wage garnishment and officially terminate the order. If you overpay, an attorney may be able to help you recover excess amounts.

Arizona does not require parents to pay for college expenses unless they voluntarily agreed to do so.

Frequently Asked Questions

Are verbal child support agreements legally binding in Arizona?

No. Verbal agreements are not enforceable. Once you are reported to DES and a support amount is approved, your employer must deduct support directly from your paycheck regardless of any verbal agreements you may have had.

Will remarriage affect my child support in Arizona?

Remarriage alone is not grounds for modifying child support in Arizona. Even if you have additional children with a new spouse, it is very difficult to reduce your existing obligation. The court considers prior children’s support obligations a priority.

What if I win the lottery?

Any lottery winnings above $600 are subject to interception by DCSS if you have child support arrears.

Can I be put on the “Most Wanted” list while in bankruptcy?

No. If you are involved in active bankruptcy proceedings or receiving welfare benefits, you will not be placed on the public “Most Wanted” list.

Can the custodial parent withhold visitation if I don’t pay?

No. Child support and visitation are separate legal matters. A custodial parent cannot legally withhold court-ordered visitation due to unpaid support. If either issue is being violated, address it through the court.

Additional Resources

Arizona Division of Child Support Services (DCSS)

Official Guidelines and Forms:

- Arizona Child Support Guidelines (AZ Courts)

- Child Support Guidelines Quick Reference

- 2022 Arizona Child Support Guidelines (Maricopa County PDF)

For personalized legal advice about your Arizona child support case, consult with a family law attorney.

More Arizona Laws